Digital in numbers, but not the numbers corporate India is used to seeing

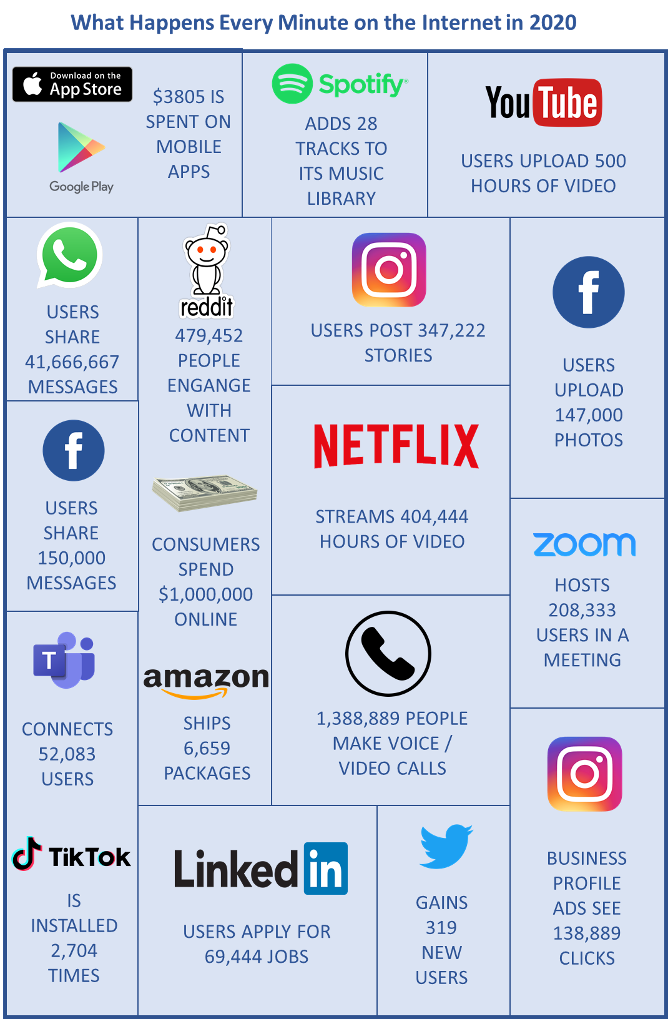

In this day and age, yesteryear business metrics such as revenue growth or profit margins, cannot adequately summarize the nascent yet vibrant digital industry. The reason why we call it nascent is that despite several decades of existence and investment, there is this overwhelming feeling of not having unearthed more than the tip of the iceberg. If you are still not convinced, just glance at the chart below.

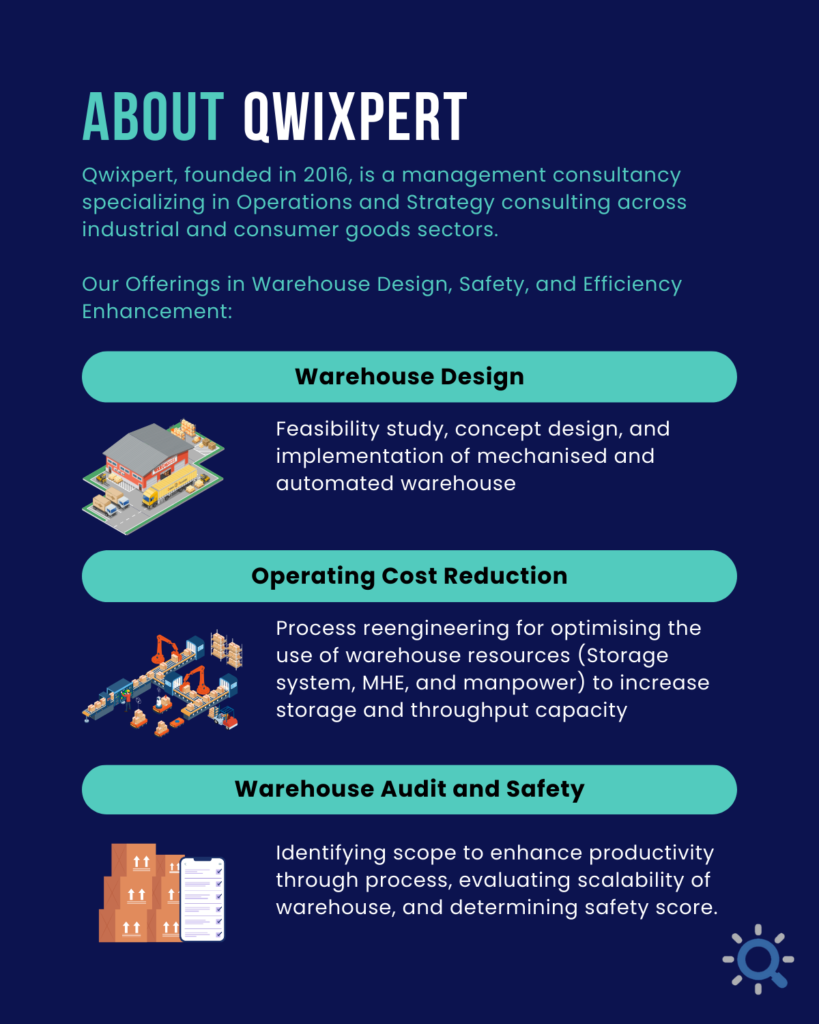

No other industry today spawns so many innovative business models, many of which were launched from the comfort of a couch. The disruption to traditional industries due to these businesses is vast and almost immediate. Like most of you, we at Qwixpert have been repeatedly astonished by the progress made in thought and action by these businesses. “Digital” also dominates discussions in the corporate world, so much so that if a word cloud of all corporate utterances were to be created, “Digital” would probably take center place in the largest font size.

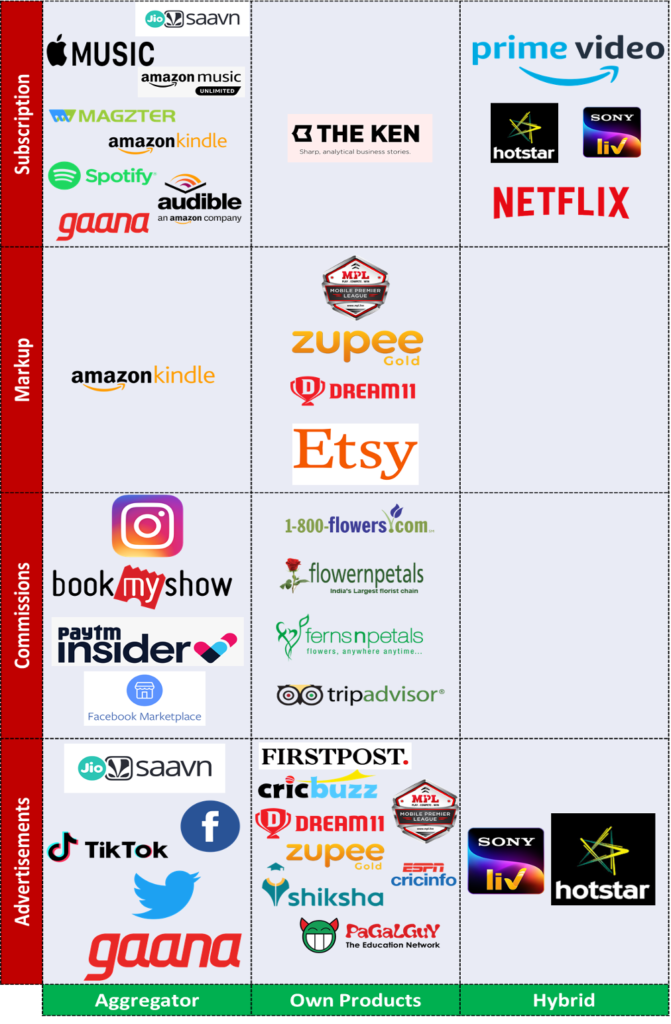

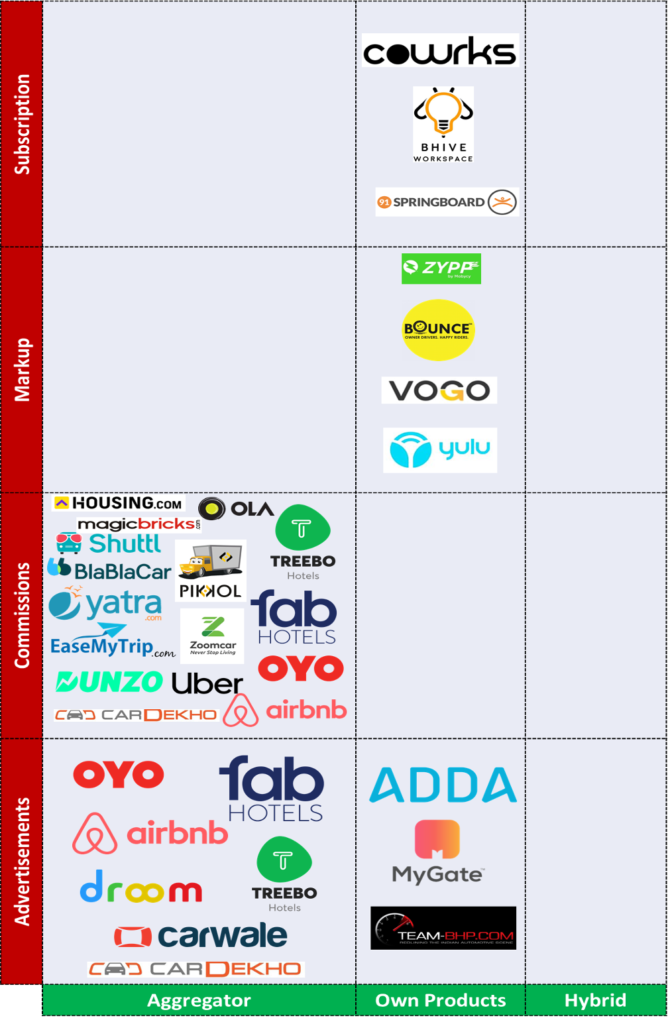

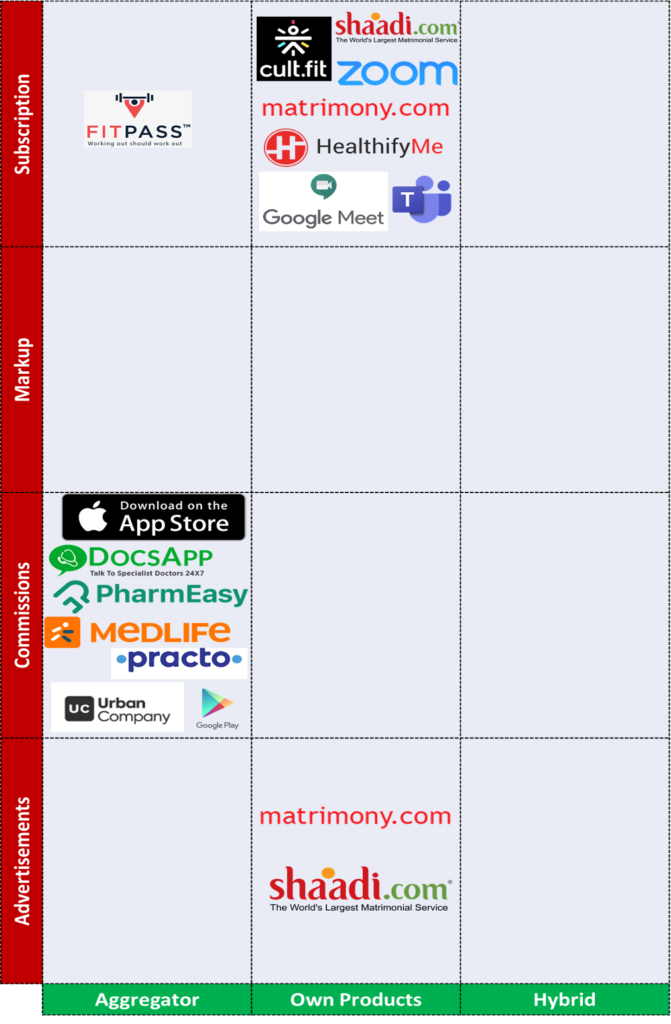

As “Digital” increasingly permeates our world, we have attempted to organize and structure it into a “Landscape.” We have limited our research to only Digital B2C businesses. The “Digital Landscape” is essentially a 2×2 matrix with “Business Model” and “Revenue Model” as its axes. These axes are defined as below

Business models can be classified into three kinds basis how consumers interact with the offerings on the digital platform

While the fine print on business contracts will reveal subtle differences in their revenue generation models, four principal types stand-out

We have tried to “landscape” several industries into a 2X2 chart – Business Model X Revenue Model. While it is not an exhaustive list, a wide variety of companies operating in the following five industry sets are covered

While companies do have hybrid revenue models, a separate category has not been carved out, but both are highlighted in case multiple revenue models are present. E.g., LinkedIn generates revenues through advertisements as well as subscriptions.

Retail – General Retail, Food & Grocery, Durables, Fashion, and Home décor

Entertainment & Leisure – Social media, OTT, News, Gaming, Music, and Gifts

Productivity – Education, Recruitment, Financial Services, and Open Source

Hospitality & Transportation – Automotive, Travel and Real Estate

Services – Health & wellness, Household help, Matrimony, and Virtual meetings

Sources:

Dear Supply Chain Head,

Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across the supply chain: workforce shortages, transport issues, government plans, demand and supply fluctuations. While there are discussions and speculations about the future, companies must undoubtedly focus on reducing cost, improve efficiencies, and manage their working capital well in the next 12 – 18 months, to emerge stronger out of this crisis.

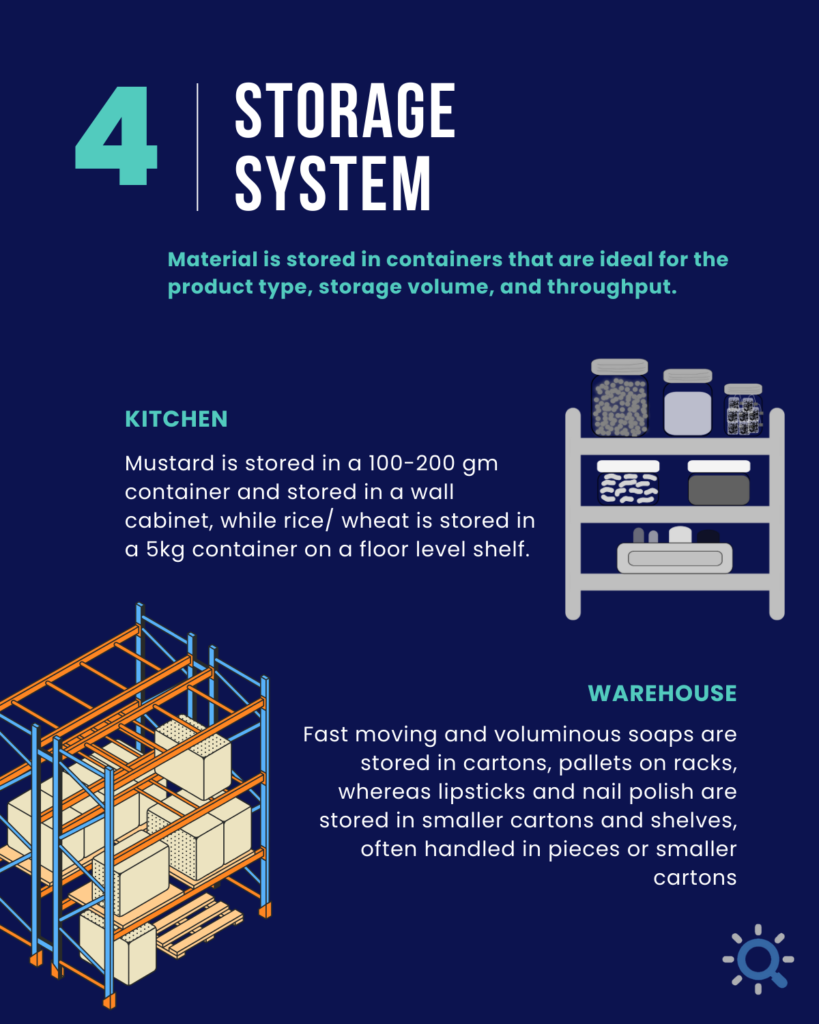

The purpose of this series is to provide simple but effective ideas to help managers improve elements of their supply chain. In this post, I share a few ideas for enhancing warehouse performance.

It is becoming a challenge for e-commerce and consumer goods companies to fulfil orders due to the non-availability of resources in their warehouses, first and last-mile distribution. The labour shortage situation will take considerable time to improve as a lot depends on when the migrant workers can return from their native. Also, the requirement of social distancing, if implemented well, will slow down processes and productivity levels. The onus is on the supply chain managers to not just resume warehouse operations well – with all the safety protocols but also to improve productivity levels to meet mid to long term goals of the businesses. Here are a few ideas to consider:

Depending on your industry and warehouse operations there could be more ideas ,but 20 – 25 % improvement in productivity is achievable. The key is to identify opportunities, spend time on planning now, and start implementing soon after operations resume.

I look forward to hearing your views on the above ideas and some more ideas if you would like to add.

In the next post, I will discuss the challenges and potential improvement opportunities in the logistics and transportation side of the supply chain.

– Rajan Ekambaram, Partner, Supply Chain Practice Qwixpert