India’s chemicals industry has been a global outperformer in demand growth with its rising domestic demand (CAGR 9.5% FY21-FY40) in chemical end-use sectors such as agriculture, consumer and retail, infrastructure, auto and electronics, and healthcare. Government initiatives under the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIR) policy and a shift in the global supply chain brought on by the China+1 strategy will fuel significant revenue growth in the sector.

The key drivers in the chemical industry market are:

At Qwixpert, we understand the challenges posed by this evolving landscape and possess extensive experience in providing effective solutions. We help a variety of chemical companies such as those in specialty chemicals, fertilizers, agro-chemicals, pigments, paints and coatings to realize a sustainable business model with improved production planning techniques, inventory management, supply chain network and focused marketing.

Allow us to outline the key trends impacting the chemical industry:

- Growing export market with India emerging as an attractive investment destination to global corporations: During FY 2023, India achieved a milestone in the chemical industry with chemical exports reaching $30 billion with a Y-O-Y Growth of 14% in terms of volume (FY 2015-2023). This upward trajectory is attributed to a combination of strong improvement in global trade as well as government initiatives that have positioned India as an appealing investment destination for global corporations aiming to diversify and mitigate supply chain risks as part of their China+1 strategy. The robust performance of the sector is prompting chemical manufacturers to ramp up their production capacity to meet the growing demand for its products. Qwixpert has successfully partnered with companies to help them:

-

- Identify lucrative business expansion opportunities in both the Indian and export markets by utilizing iterative shortlisting based on market size, growth outlook, operational and regulatory complexities, and potential for synergy.

- Develop comprehensive capacity planning strategies by evaluating production capabilities, equipment utilization, and resource allocation, and suggest optimization and debottlenecking strategies to maximize output

- Increasing consumer expectations and new products leading to SKU proliferation: With growing demand for biofriendly products and increasing consumer expectations for performance, durability, and safety, chemical companies need to develop specialized chemical solutions to meet these demands. For example, in the automotive industry, there is a proliferation of SKUs for specialty coatings, adhesives, and polymers to meet the specific requirements of different vehicle models and applications. The increasing number of SKUs seemingly cannibalises sales and increases production lead time due to batch production set up. We have assisted several businesses in precisely matching aggregate supply with demand, properly plan inventory, optimize production planning process, and maximize fulfilment over the sales and operation process (S&OP). We also specialize in analysing the right target group and recommend strategies for focussed marketing/promotion.

- Supply chain disruptions leading to inflationary pressure: Persistent disruptions in the global supply chain network coupled with the on-going geopolitical conflict have caused widespread inflationary pressure across key commodities. E.g., Paint and pigment industries have suffered with availability constraints across commodities like monomers, Titanium Dioxides and speciality additives making it very important for them to secure future supply of material. We recently collaborated with a leading pigment manufacturing company, where we achieved significant savings potential by redesigning the inventory strategy and leveraging our forecasting capabilities to ensure timely procurement of raw material requirements, striking a balance between inventory carrying and stockout.

- Cost-pressure and declining margins: The industry is facing a significant challenge of contracting gross margins due to steep rise in raw material costs; companies saw a ~5% decline in profitability attributed to 13% increase in cost of goods sold. Swift implementation of price increases to counteract the inflation in raw material cost, improving the product mix and identifying cost-effective material sourcing avenues can help businesses protect their margins. Qwixpert can help companies in minimising the impact of increasing costs and contain losses by identifying the right product mix through big data and analytics, reducing wastages in raw material, establishing long-term contracts or vertical integrations and implementing warehouse cost optimization measures.

The favourable growth projections make this an ideal time to grow the business but for long term value generation, cost-reduction and efficiency improvement measures are important. Qwixpert has experience in doing just that. Let us help you get healthy bottom lines while helping you realise your growth ambitions.

What can we do?

Our Solutions for Chemical and Paint Industry

Business Strategy

Revenue Generation

Profitability Enhancement

Business Strategy

Revenue Generation

Profitability Enhancement

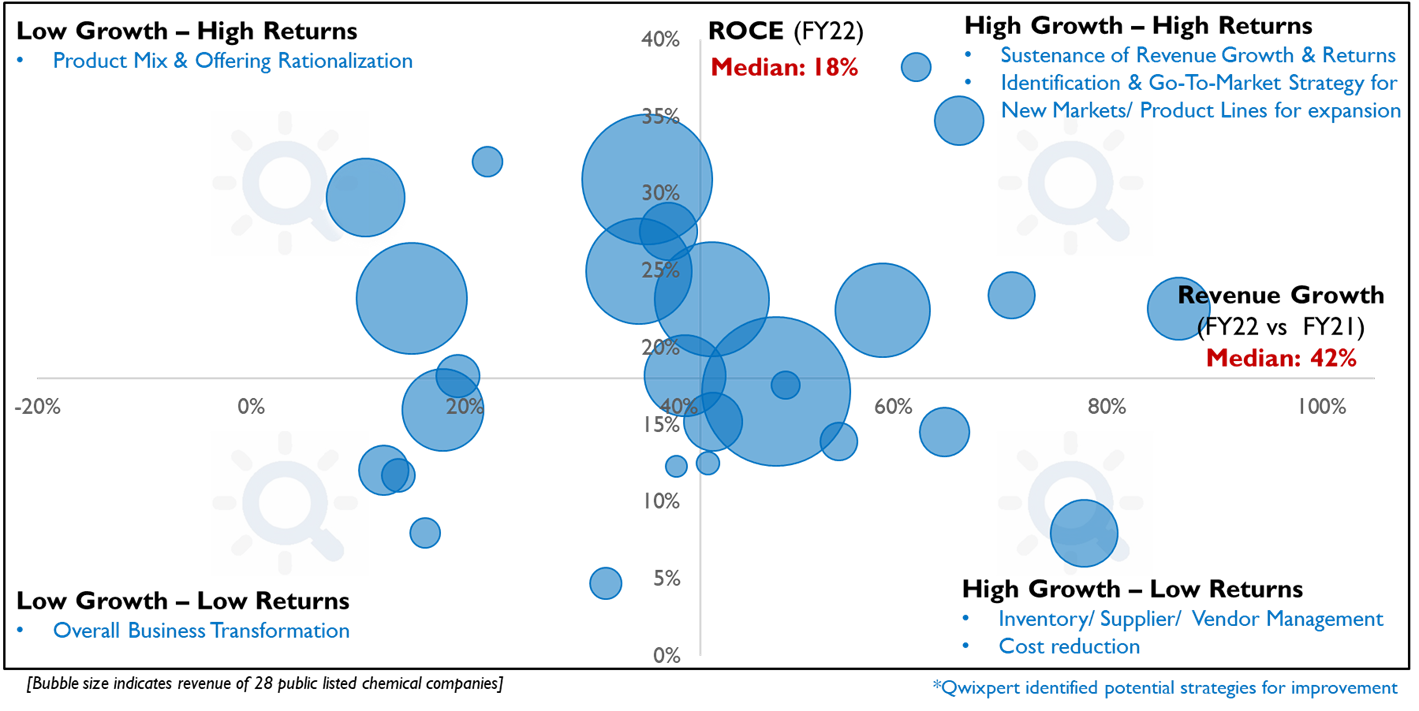

Our insights

In the fiscal year 2022, the Chemical Industry in India experienced a remarkable surge in growth, showcasing an impressive industry median of 42%. This substantial growth in the industry was accompanied by a notable improvement in the Return on Capital Employed (ROCE), which grew by 10% YoY, leading to an industry median of 18%. These positive trends highlight the Chemical Industry’s robust performance and its capacity to deliver enhanced returns on invested capital, reaffirming its position as a thriving and profitable sector.

Read More Insights:

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky https://qwixpert.com/wp-content/uploads/2023/08/Picture1-scaled.jpg 2560 1706 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary: This article talks about the ballooning demand for Indian Single Malts India & global markets. Growing demand has…

How would FMCG distribution of the future look like?

How would FMCG distribution of the future look like? https://qwixpert.com/wp-content/uploads/2023/07/Introductory-image.png 781 527 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Emerging Tech based B2B models are disrupting the traditional distribution space. Unlike the traditional distribution model which has…

How to address the Channel Conflicts in FMCG Distribution?

How to address the Channel Conflicts in FMCG Distribution? https://qwixpert.com/wp-content/uploads/2023/07/FMCG-Article-1-Title-Picture_Word.png 602 401 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gIntroduction We would remember the times when grocery lists were an ubiquitous phenomenon. The local grocer or the kirana was…

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment?

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment? https://qwixpert.com/wp-content/uploads/2023/07/Eco-Fuel.jpg 979 489 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary India imports ~84% of its oil requirement. Ethanol Blending Program (EBP) is being promoted with vigour to help…

Indian B2C Digital business landscape

Indian B2C Digital business landscape https://qwixpert.com/wp-content/uploads/2023/07/Picture9-scaled.jpg 2560 1707 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDigital in numbers, but not the numbers corporate India is used to seeing In this day and age, yesteryear business…

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them https://qwixpert.com/wp-content/uploads/2020/09/4.1_Industries_Alcoholic-beverages-1024x442-1.jpeg 1024 442 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Per-capita alcohol consumption has seen an almost 3 fold increase since 2005 in India. A young population with…

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery?

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery? https://qwixpert.com/wp-content/uploads/2023/07/Page-1_Image.jpg 1379 916 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The coronavirus pandemic and the subsequent lockdown has crippled the foodservice industry. With operational constraints and an increase…

Simple ideas to improve warehouse efficiencies

Simple ideas to improve warehouse efficiencies https://qwixpert.com/wp-content/uploads/2023/07/Warehouse-1536x1024-1.jpg 1536 1024 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDear Supply Chain Head, Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across…