The consumer goods market in India is experiencing a rapid transformation as more brands (global, traditional, and D2C) enter the segment, and customers have an unprecedented array of choices. As a result, customers now have higher expectations from brands.

The segment is slated for positive 7-9% growth in 2023 after the ease of inflationary pressure and disappointing performance in FY22.

Key Drivers in Consumer Goods

At Qwixpert, we understand the challenges this evolving landscape poses and possess extensive experience in providing effective solutions. Allow us to outline the three key trends impacting the consumer goods industry:

- Cost-pressure and inflation: Rising input prices and tightening consumer budgets due to inflation puts pressure on margins. In FY22, companies saw a ~15% decline in profitability due to 8-10% input price increase. Focusing on margin optimization in existing products is crucial to ensure businesses can handle inflation. For example, we recently collaborated with a leading FMCG (Personal and Home Care) company, achieving a significant savings potential of 8%. By redesigning the outbound distribution network, we streamlined processes such as reducing the number of CFA’s, optimizing material touchpoints, and implementing warehouse cost optimization measures.

- Development of new business models to maximise coverage: Catering to the customer demand for sustainably designed, customised, yet affordable products, the D2C segment is set to record a 40% YoY growth. Owing to lower establishment costs, these brands target emerging segments like male grooming, natural beauty (1.5x growth of overall market), etc. Companies like Honasa Consumer, Good Glam, etc., have unlocked new revenue sources by developing a house of brands. Traditional brands are also evaluating growing segments, and the acquisition of Raymond consumer care by the Godrej group and Beardo by Marico is a testament to the growing interest in white-space explorations. We have assisted businesses in evaluating the potential of new market segments, taking into account the lucrativeness and investment requirements. Through detailed profiling of micro-market behaviour, evaluating the growth opportunities for the product, and considering the organisational capability development, we can help you unlock the next-level growth for your company.

- The rise of digital customers and channel conflicts: With e-commerce sales growing by ~70% and 74% growth of order value, digital penetration of non-food FMCG is set to rise further as the segment is expected to contribute 11% (of overall FMCG) by 2030 and reduce the share of General Trade (GT) channel. This shift presents three key challenges:

- Establishing appropriate margins and incentives for GT: The margin structure for the GT channel is typically based on ROI. The recent loss of sales volume in GT due to deep discounting and better margins in online B2C and B2B channels is threatening profitability for GT channels. Considering the indomitable reliance on GT in Indian retail, it’s imperative to avoid channel conflicts, support GT channel partners through monetary relaxations, and improve operations performance to compete with new-age players. We have assisted an FMCG company in conducting bottom-up calculations to determine the right margins and incentives for GT partners. The projects ensured the client’s continued relevance in an evolving market and facilitates sales growth and efficiency improvement.

-

- Enhancing efficiency in order fulfilment from CFA: Secondary order fulfilment for MT/ E-com is more challenging due to nuances like appointment-based deliveries, detainment, etc. Since CFAs cater to both the general trade and the other trade channels, secondary logistics costs are often high across all channels due to larger fleet sizes, lower utilisation rates, and improper dispatch planning. Drawing upon our experience in secondary logistics, we have developed a proprietary tool that optimizes route planning. We have incorporated this tool during an engagement with a large FMCG personal care brand, and through dynamic route selection, fleet size optimization, and vendor negotiations; we ensured cost-effective delivery within stipulated service levels across all channels.

-

- Leveraging customer data insights: Through salesforce integration till secondary sales and shift of sales to online modes, companies have access to the data of individual consumers. The data can indicate customer trends such as pack size, price sensitivity, typical bundling, etc. With the shift towards digital sales, being able to draw targeted insights from data will generate a competitive advantage. It opens up the potential of reaching out to consumers via multiple digital mediums and seamlessly integrating the online and offline buying experience.

At Qwixpert, we recognize this as an opportunity for brands to offer innovative experiences and acquire new customers. By working with us, you can enhance your business’s resilience and develop strategies for achieving next-level performance in the evolving consumer market, all while maintaining a sharp focus on profitability.

Let us guide you through this transformative journey and help you thrive in the dynamic world of consumer goods.

What can we do?

Our Solutions for Consumer Goods Industry

Business Strategy

Revenue Generation

Profitability Enhancement

Business Strategy

Revenue Generation

Profitability Enhancement

Our insights

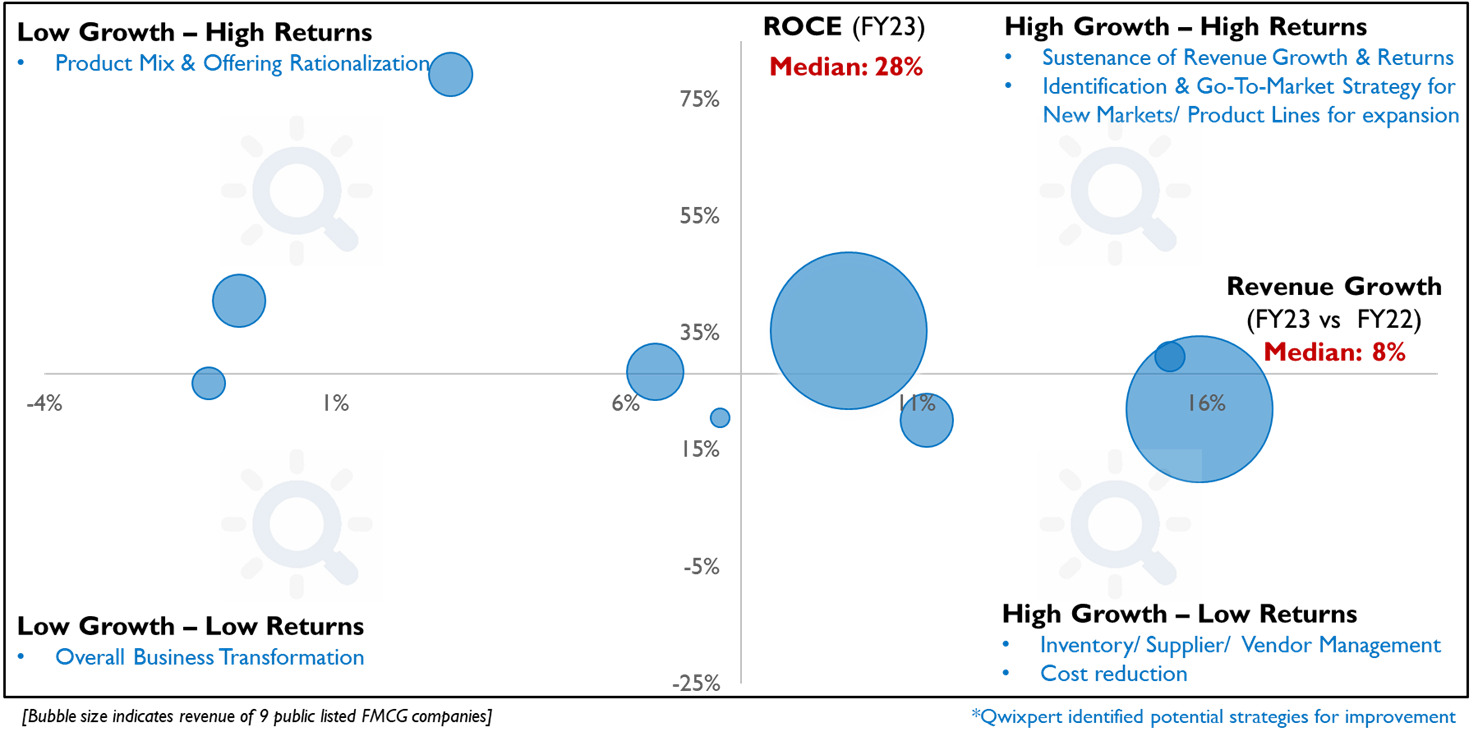

In FY23, the Indian FMCG Industry witnessed a growth rate of 8%, lower than the previous year’s 11%. Despite a YoY dip of 7% in ROCE, the industry maintains a respectable median of 28%, reflecting its resilient performance.

Read More Insights:

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky https://qwixpert.com/wp-content/uploads/2023/08/Picture1-scaled.jpg 2560 1706 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary: This article talks about the ballooning demand for Indian Single Malts India & global markets. Growing demand has…

How would FMCG distribution of the future look like?

How would FMCG distribution of the future look like? https://qwixpert.com/wp-content/uploads/2023/07/Introductory-image.png 781 527 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Emerging Tech based B2B models are disrupting the traditional distribution space. Unlike the traditional distribution model which has…

How to address the Channel Conflicts in FMCG Distribution?

How to address the Channel Conflicts in FMCG Distribution? https://qwixpert.com/wp-content/uploads/2023/07/FMCG-Article-1-Title-Picture_Word.png 602 401 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gIntroduction We would remember the times when grocery lists were an ubiquitous phenomenon. The local grocer or the kirana was…

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment?

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment? https://qwixpert.com/wp-content/uploads/2023/07/Eco-Fuel.jpg 979 489 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary India imports ~84% of its oil requirement. Ethanol Blending Program (EBP) is being promoted with vigour to help…

Indian B2C Digital business landscape

Indian B2C Digital business landscape https://qwixpert.com/wp-content/uploads/2023/07/Picture9-scaled.jpg 2560 1707 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDigital in numbers, but not the numbers corporate India is used to seeing In this day and age, yesteryear business…

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them https://qwixpert.com/wp-content/uploads/2020/09/4.1_Industries_Alcoholic-beverages-1024x442-1.jpeg 1024 442 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Per-capita alcohol consumption has seen an almost 3 fold increase since 2005 in India. A young population with…

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery?

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery? https://qwixpert.com/wp-content/uploads/2023/07/Page-1_Image.jpg 1379 916 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The coronavirus pandemic and the subsequent lockdown has crippled the foodservice industry. With operational constraints and an increase…

Simple ideas to improve warehouse efficiencies

Simple ideas to improve warehouse efficiencies https://qwixpert.com/wp-content/uploads/2023/07/Warehouse-1536x1024-1.jpg 1536 1024 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDear Supply Chain Head, Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across…