With increasing demand from rural, public infrastructure and enabled by the government’s impetus on infrastructure, the cement industry in India is growing.

Drivers for Cement Industry

With the macro-factors primed for bringing a new phase of growth in the cement segment, Qwixpert has identified key trends that companies should be cognizant of:

- Asset utilisation is key in cement industry due to high CapEx: Since mines are on lease basis for limited period and heavy-duty expensive machinery is used for transportation and crushing activities; the utilisation of asset in both extraction and production process are key to maximise value. Interventions targeting line balancing from the mining activity, transportation, crusher to the kiln can yield healthy bottom-lines. With healthy growth forecasts for the industry, the importance of improving capacity utilisation (from median 75%) can generate better returns. Qwixpert has experience in helping companies plan production around bottle neck processes in order to enhance the overall productivity of the system.

- Strong focus on logistics cost reduction prevalent across the sector: Compared to traditional consumer goods, pharma etc. the share of logistics cost in revenue (~25% in cement) is 5 -8x more. Transporting a low-value but bulky material over long distances is challenging and requires large fleet size, diligent planning of dispatches and careful balance of inventory levels. Through government support of cement corridors, measures taken such as integrated plants, optimising fleet usage and network design to identify right location for nodes, we believe there are multiple levers for realising savings in logistics. Qwixpert has a strong portfolio in logistics cost reduction. We have designed the entire outbound network for a large manufacturer consisting of Logistics, warehousing and inventory strategy. Our solution focused on reducing multiple handlings, increasing share of long-haul direct dispatches to customers and recommending larger truck sizes that can increase utilisation rates. 8% reduction on supply chain cost was unlocked through this engagement. In another engagement, Qwixpert undertook route-optimisation of dispatches from warehouse to customer (Dealer) by identifying the right routes for milk-run, planning for fleet requirement during peak and non-peak months and vendor negotiations.

- Input material availability and inflationary pressure: Apart from the challenge of inbound logistics with material such as coal, limestone that are produced in specific geographies and are transported for ~700 kms to integrated units; the challenge of surges in input prices and shortages of raw material also threaten margins. Increase in coal and crude oil prices due to geopolitical disruptions had previously resulted in a ~10% decline in margins (H1FY23). By exploring low-cost additives or alternate fuel sources, reusing and reducing wastages in raw material and by establishing long-term contracts or vertical integrations, companies can counter the challenges of input price volatility. Product innovations like blended and premium products can also help with margin pressures.

The favourable growth projections makes this an ideal time to invest in capacity expansion and other expansion projects; but for long term value generation, cost-reduction and efficiency improvement measures are important. Qwixpert has experience in doing just that. Let us help you get healthy bottom lines while helping you realise your growth ambitions.

What can we do?

Our Solutions for Cement Industry

Business Strategy

Revenue Generation

Profitability Enhancement

Business Strategy

Revenue Generation

Profitability Enhancement

Our insights

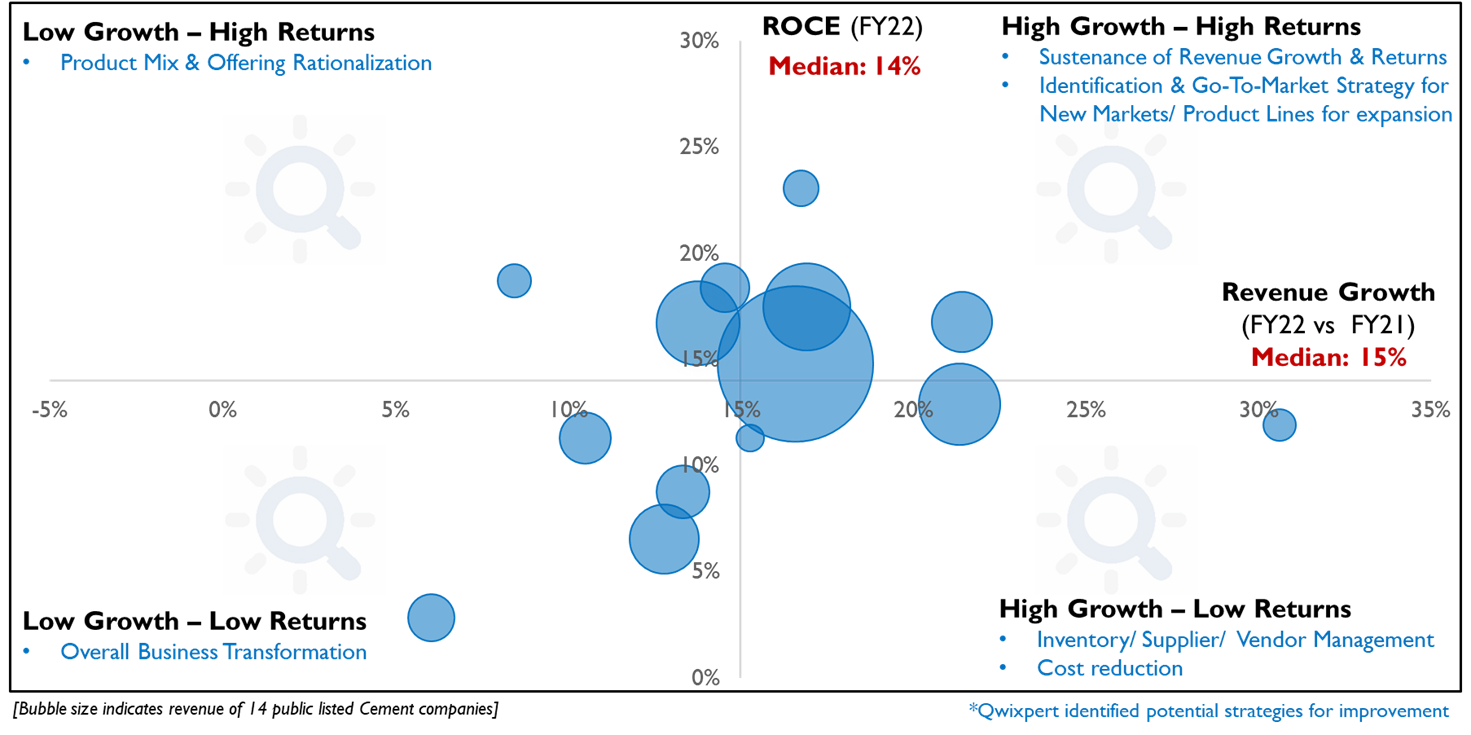

In the financial year 2022, the cement companies we track have shown promising growth with an industry median of 15%. However there has been a slight dip of 1% in ROCE resulting in industry median to reach 14%. Despite this slight dip, the industry’s performance remains commendable, reflecting the sector’s overall positive trajectory.

Read More Insights:

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky https://qwixpert.com/wp-content/uploads/2023/08/Picture1-scaled.jpg 2560 1706 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary: This article talks about the ballooning demand for Indian Single Malts India & global markets. Growing demand has…

How would FMCG distribution of the future look like?

How would FMCG distribution of the future look like? https://qwixpert.com/wp-content/uploads/2023/07/Introductory-image.png 781 527 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Emerging Tech based B2B models are disrupting the traditional distribution space. Unlike the traditional distribution model which has…

How to address the Channel Conflicts in FMCG Distribution?

How to address the Channel Conflicts in FMCG Distribution? https://qwixpert.com/wp-content/uploads/2023/07/FMCG-Article-1-Title-Picture_Word.png 602 401 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gIntroduction We would remember the times when grocery lists were an ubiquitous phenomenon. The local grocer or the kirana was…

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment?

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment? https://qwixpert.com/wp-content/uploads/2023/07/Eco-Fuel.jpg 979 489 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary India imports ~84% of its oil requirement. Ethanol Blending Program (EBP) is being promoted with vigour to help…

How will the addition of 2 new teams impact the P&L of current teams?

How will the addition of 2 new teams impact the P&L of current teams? https://qwixpert.com/wp-content/uploads/2023/07/82858638_s.jpg 660 726 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gThe pandemic has changed the lives of millions across the globe, personally and professionally. Entertainment is no outlier, with India’s…

What should auto manufacturers do to succeed in the Electric Vehicle era? – Automotive industry’s smartphone moment

What should auto manufacturers do to succeed in the Electric Vehicle era? – Automotive industry’s smartphone moment https://qwixpert.com/wp-content/uploads/2023/07/EV-Charging-Main-Picture.jpeg 774 619 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary The migration to Electric Vehicles from Internal Combustion Engine technology has gathered pace. Customer anxieties over their purchase…

Ola’s road to profitability: What lies ahead for one of India’s favorite unicorns?

Ola’s road to profitability: What lies ahead for one of India’s favorite unicorns? https://qwixpert.com/wp-content/uploads/2023/07/Microsoft-stock-image.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary Very few businesses can lay claim to changing the habits of a population. Ola, with its convenient and…

Medical Devices and Consumable: A Sunrise Sector with Lucrative Opportunities and Unique Challenges

Medical Devices and Consumable: A Sunrise Sector with Lucrative Opportunities and Unique Challenges https://qwixpert.com/wp-content/uploads/2023/07/Title-image.jpg 601 459 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The pandemic hit India in February-March 2020 setting the healthcare industry in overdrive. Patients needed treatment for a…

How can the Indian API industry grow rapidly and compete in the global market?

How can the Indian API industry grow rapidly and compete in the global market? https://qwixpert.com/wp-content/uploads/2023/07/1.-Title.png 931 616 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The Indian Pharmaceutical Sector is expected to grow to Rs. 7,371 Billion by 2025 from the current Rs.…

Indian B2C Digital business landscape

Indian B2C Digital business landscape https://qwixpert.com/wp-content/uploads/2023/07/Picture9-scaled.jpg 2560 1707 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDigital in numbers, but not the numbers corporate India is used to seeing In this day and age, yesteryear business…

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them https://qwixpert.com/wp-content/uploads/2020/09/4.1_Industries_Alcoholic-beverages-1024x442-1.jpeg 1024 442 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Per-capita alcohol consumption has seen an almost 3 fold increase since 2005 in India. A young population with…

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery?

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery? https://qwixpert.com/wp-content/uploads/2023/07/Page-1_Image.jpg 1379 916 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The coronavirus pandemic and the subsequent lockdown has crippled the foodservice industry. With operational constraints and an increase…

Simple ideas to improve warehouse efficiencies

Simple ideas to improve warehouse efficiencies https://qwixpert.com/wp-content/uploads/2023/07/Warehouse-1536x1024-1.jpg 1536 1024 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDear Supply Chain Head, Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across…

Why a business case approach, to costs of owning an IPL team, is more prudent?

Why a business case approach, to costs of owning an IPL team, is more prudent? https://qwixpert.com/wp-content/uploads/2020/04/Picture28.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary In the previous article, the major revenue streams – Central Rights income, Sponsorships, Match day incomes were detailed…

Leveraging analytics to increase sales conversions and improve lead sourcing

Leveraging analytics to increase sales conversions and improve lead sourcing https://qwixpert.com/wp-content/uploads/2023/07/3.2_Services_sales-and-marketing-e1571141506341.jpg 1171 390 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary Lead prioritization model is a predictive algorithm to score and classify leads. Primarily used by sales organizations to…

How do IPL teams make money?

How do IPL teams make money? https://qwixpert.com/wp-content/uploads/2023/06/Cricket-Bat.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary IPL is now among the top 10 leagues in the world by broadcasting revenue. For a brand which…