The pandemic has changed the lives of millions across the globe, personally and professionally. Entertainment is no outlier, with India’s cricket-crazy fan base missing the experience of live matches. The 2020 IPL season was a much-awaited bloom in the drought. BARC India’s viewership data indicates an overwhelming response to IPL 2020. 405 million viewers tuned in to watch the IPL. Indian audiences consumed 400 billion minutes of IPL this year, leading to a 23% increase in consumption over the previous year.

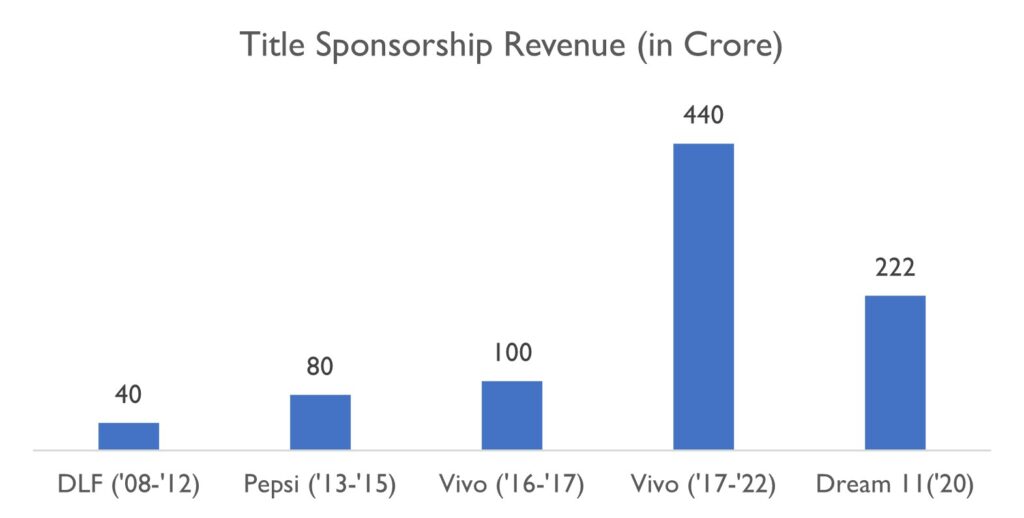

The franchise finances have, however, taken a hit this year. Revenues dropped significantly due to the lower title sponsorships (Vivo’s Rs. 440 Cr. vs. Dream 11 Rs. 222 Cr.), reduced jersey sponsorships, and loss of match day income due to the shifting of venues to Dubai.

Will adding two new franchises be a boon or a bane for the existing franchises? If added, how will it further affect the business prospects of existing franchises?

Teams may have to take home a lower share of the broadcasting rights revenues – their major revenue contributor

Currently, the eight teams play a total of 56 matches in a league format (both home and away) and 4 matches in the knockout round, resulting in a total of 60 matches. If the BCCI members (state associations) approve two new teams in the annual meeting in December end, it will not be the first time the IPL has had ten franchises in a season. In 2011, BCCI added Pune Warriors and Kochi Tuskers to the original roster of eight franchises. The home-and-away format, which would have meant a total of 94 matches, was shelved due to fear of burnout. Consequently, the IPL split the ten teams into two loose groups with 70 league matches and four playoff games. Teams, though, were ranked together in one composite league table.

The proposal by BCCI for the new IPL format, if the two new teams are added, is that during the league phase, every team will play the same number of league matches (14) as of today. The teams will be split into two groups of 5. Each team will play the other four in their group, in both home and away format (8 matches), four of the teams in the other group once (4 matches, either home or away), and the remaining team in the other group twice, in both home and away. A random draw will decide the groups’ composition and who plays whom across the groups once and twice.

The broadcasting rights revenue of Rs 3,200 from Star India is less likely to increase with the addition of 2 new teams, especially with the tournament length unchanged. Hence the central rights share given to the franchises is expected to remain the same at Rs 1,600. The addition of 2 teams may lead to the existing teams getting a 20% (Rs 40 Cr) lesser share of central revenue. While the title sponsorship fell by ~50% in IPL 2020, it is expected to increase in 2021 and beyond as the tournament returns to India.

Franchisees must leverage sponsorships and brand extensions to offset rights income drop

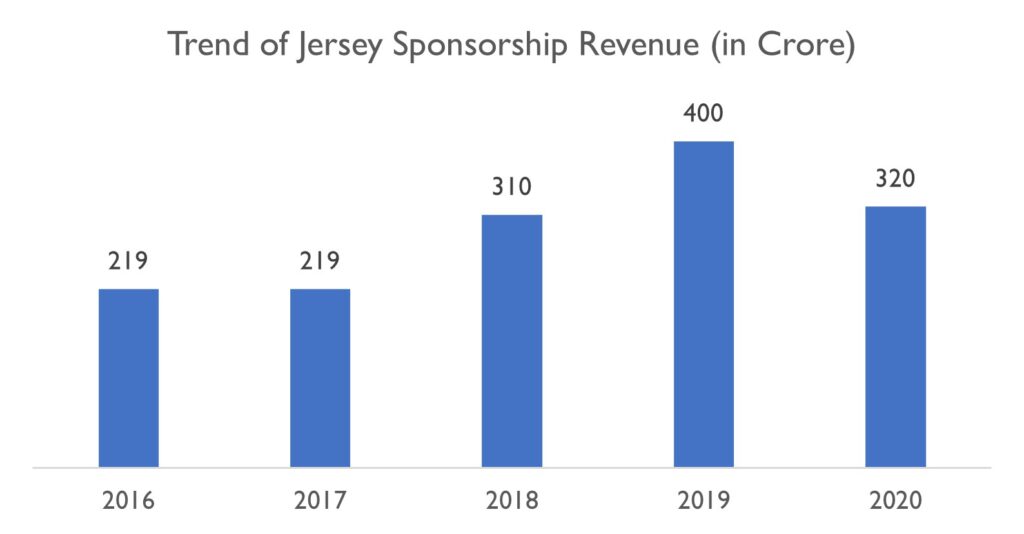

Leading franchises have seen a 10-15% decline in 2020; for the rest, sponsorship amount has dropped by 25-30%. This year the eight franchises are estimated to have earned anywhere between Rs 300-350 crore, compared to Rs 400 crore last year.

The top four franchises earn between Rs 70-80 crore from sponsorship, while the remaining four franchise’s earnings ranges from Rs 30 to Rs 40 crore. Even as franchises could close most of the deals before lockdown, a lot of the inventory, such as space at the back of the helmet, non-leading arm, remained unsold.

From 2016 – 2017 the eight teams’ total sponsorship revenue remained flat at Rs 219 crore. In the 2018 edition of IPL, sponsorship revenue grew by 37% – 46%. The total sponsorship pacts signed by the eight teams were in the range of Rs 300–320 crore.

Sponsorships are dependent on the team’s star players and fan base. New franchisees may struggle to generate much in the initial seasons. However, the existing franchisees having an established core group of international stars and cultivated a loyal fan following will continue the growing trend. Brand extensions will become significant as teams identify ways to engage fans even beyond the IPL season. RCB Bar and Café, inaugurated on 19th Dec in the heart of Bangalore, is a case in point.

Ticketing Revenue may shrink by ~10% – 15% with lower home matches/team; a holistic approach to augmenting in-stadium revenues imperative

BCCI, in the past, had compensated franchises when the T20 tournament moved out of India to countries such as South Africa and UAE – the situation was different this year. The teams had to let go of earning from the ticket sale, which amounts to ~Rs. 400 crore. While upcoming seasons are expected to happen in India, 1 or 2 lesser home matches/team indicates lower earnings. With occupancy at ~87% overall, teams will have to maximize seat utilizations through intelligent use of analytics and augment in-stadium revenues with activities engaging fans pre- and post-matches.

Conclusion

BCCI’s AGM on 24th Dec 2020 is likely to pass the proposal to add two new teams to the IPL. It is expected that the 2021 season will remain unchanged with a mini-auction in February. The 2022 season will start with a mega auction at the beginning of 2022. This allows sufficient time for franchisees to prepare in the back end – with coaching and support staff, talent scouts identifying potential auction picks, sponsorship and marketing planning, stadium preparation, and pre-season fan engagement.

BCCI may tweak the share of central rights income from 50:50 to 60:40. While this impacts BCCI’s revenues, the new franchisee bids (Expected @ $300 Mn as per a Times of India report) is expected to compensate for the drop. However, teams must develop self-sufficiency in income generation and not remain overly dependent on the central rights income share. Enriching the in-stadia experience for fans will augment income generation. Fan and sponsor engagement beyond the playing season to generate higher sponsorship and brand extension incomes are critical for long term franchisee viability.

The BCCI’s AGM will throw some light on the upcoming IPL seasons. For the cricket crazy fans at large, the show gets only more exciting.

-By Gopika Hemachander and Maheswaran Ganapathy