With India being the largest producer of milk in the world and dairy products being an intrinsic part of consumer diet, the dairy segment in India is poised to register double-digit value growth (10% FY21-FY25).

The key drivers of dairy segment are:

Due to the Cooperative driven model of the dairy industry in India, an increase in raw material prices cannot always be passed on to the customer. Compensating the farmers and supporting them using inputs like feeds and veterinary support not just fosters loyalty but also supports the cooperative ethos. However, it has a negative impact on margins. Constrained on both sides, there are three key techniques to protect margins:

- Increasing scale of operations: Low margins and low growth can be fixed by increasing the procurement volume and improving asset utilization. This includes:

- Procurement Scale: Procuring in scale by working with farmers for cattle well-being, benchmarking and determining the right procurement prices, and cultivating long-term relationships with farmers

- Production and Distribution: The impact of higher procurement volume will directly translate to better utilisation of inbound logistics trucks, chilling centres, processing units, outbound logistics, and downstream sales outlets.

- Sales Growth: Qwixpert has worked with a leading dairy player to identify sales growth potential. Through micro-market segmentation and customer behaviour profiling, we identified a growth potential of 30%. This included better penetration rates, increasing coverage and scope of new product developments

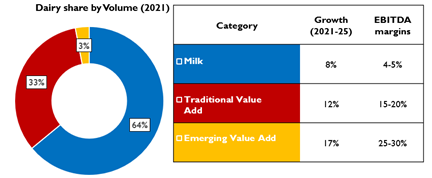

- New Product Development: With the market for modern value-added products growing at a strong 17% CAGR, companies can explore new categories such as Organic products (milk and VAP growing at 30%), Whey drinks (11% growth), Yogurt (24% growth). Qwixpert has experience in working on feasibility evaluation for new product development. By identifying all potential products in the industry through market benchmarking and shortlisting based on operational feasibility, market lucrativeness, and growth potential, we have helped select top products for GTM with strategies to achieve a 10% share and Rs. 150 Cr. topline.

- Improving the efficiency of unit economics

- Procurement Cost Reduction: Cost drivers for procurement include inbound logistics and the efficiency of the chilling centre. Through our in-house route optimisation tool, we can help devise the right route for inbound and determine the right fleet composition.

- Improving production efficiency: The major cost-head in manufacturing is utilities; by using our network of experts, we can help reduce manufacturing cost per unit by reducing wastages, improving yield by upstream quality management, and optimising the utilisation of the bottleneck processes.

- Optimising the product mix: The cost of servicing a market involves channel cost (margins), outbound supply chain, and ATL marketing spend; with a wide range of products with different shelf life, optimising the right product for the market becomes critical. This involves strategies such as increasing penetration (density) for milk while focusing on coverage enhancement for long shelf-life products.

With a strong growth outlook and consumer shift towards premium-high margin products, Qwixpert believes that understanding the nuances in customer preferences and taste profiles that vary by demography and region is key to cracking the market. We have experience in helping dairy companies understand and cater to the customer’s taste cost–effectively.

What can we do?

Our Solutions for Dairy Industry

Business Strategy

Revenue Generation

Profitability Enhancement

Business Strategy

Revenue Generation

Profitability Enhancement

Our insights

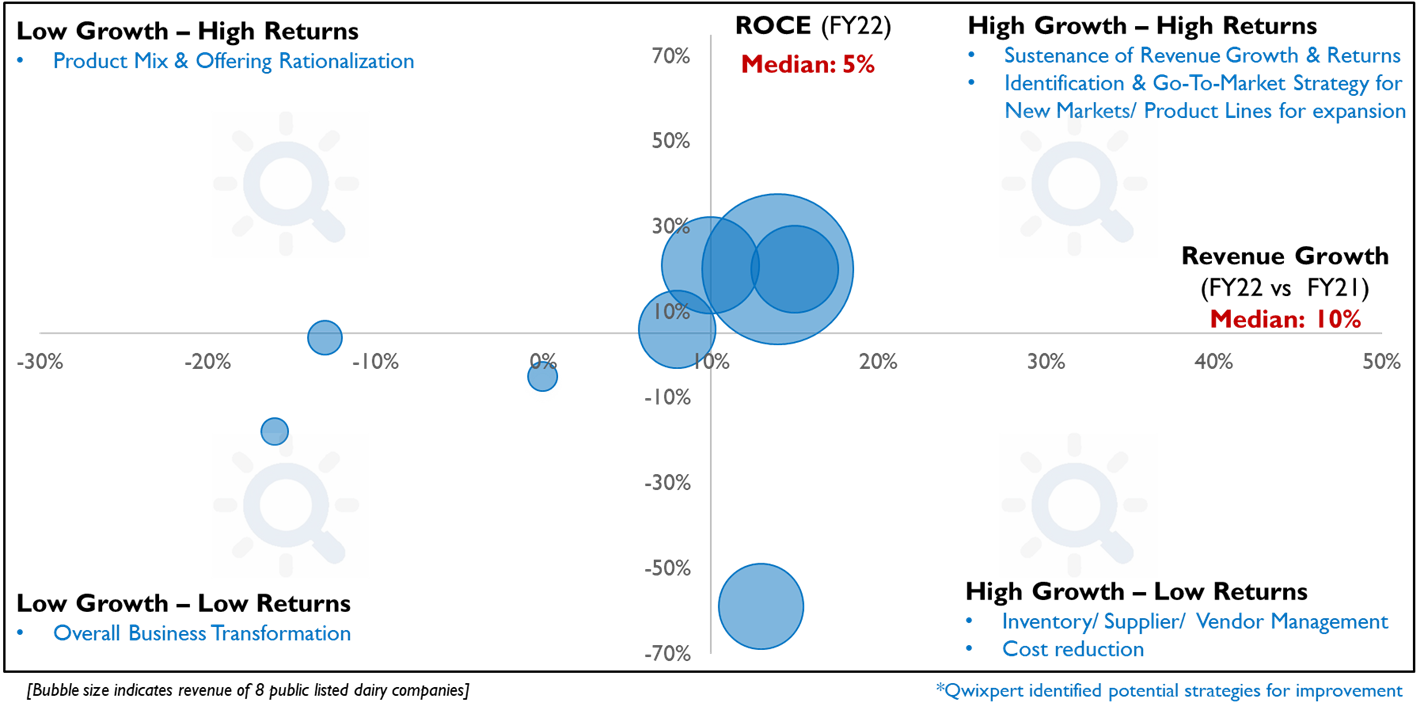

In the financial year 2022, the industry has shown promising revenue growth with an industry median of 10%. However RoCE has taken a plunge from 25% in FY21 to a meagre 5% in FY22. High 2-digit inflation in fodder cost, Low milk yield and quality due to malnourished milch population and cattle diseases such as LSD among the key reasons for reduced profitability.

Read More Insights:

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky

Rising Spirits: The Surging Popularity of Indian Single Malt Whisky https://qwixpert.com/wp-content/uploads/2023/08/Picture1-scaled.jpg 2560 1706 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary: This article talks about the ballooning demand for Indian Single Malts India & global markets. Growing demand has…

How would FMCG distribution of the future look like?

How would FMCG distribution of the future look like? https://qwixpert.com/wp-content/uploads/2023/07/Introductory-image.png 781 527 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Emerging Tech based B2B models are disrupting the traditional distribution space. Unlike the traditional distribution model which has…

How to address the Channel Conflicts in FMCG Distribution?

How to address the Channel Conflicts in FMCG Distribution? https://qwixpert.com/wp-content/uploads/2023/07/FMCG-Article-1-Title-Picture_Word.png 602 401 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gIntroduction We would remember the times when grocery lists were an ubiquitous phenomenon. The local grocer or the kirana was…

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment?

Ethanol Blending Program – What is the opportunity for Indian manufacturers in Ethanol production and why it can precipitate a “Gold Rush” moment? https://qwixpert.com/wp-content/uploads/2023/07/Eco-Fuel.jpg 979 489 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary India imports ~84% of its oil requirement. Ethanol Blending Program (EBP) is being promoted with vigour to help…

How will the addition of 2 new teams impact the P&L of current teams?

How will the addition of 2 new teams impact the P&L of current teams? https://qwixpert.com/wp-content/uploads/2023/07/82858638_s.jpg 660 726 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gThe pandemic has changed the lives of millions across the globe, personally and professionally. Entertainment is no outlier, with India’s…

What should auto manufacturers do to succeed in the Electric Vehicle era? – Automotive industry’s smartphone moment

What should auto manufacturers do to succeed in the Electric Vehicle era? – Automotive industry’s smartphone moment https://qwixpert.com/wp-content/uploads/2023/07/EV-Charging-Main-Picture.jpeg 774 619 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary The migration to Electric Vehicles from Internal Combustion Engine technology has gathered pace. Customer anxieties over their purchase…

Ola’s road to profitability: What lies ahead for one of India’s favorite unicorns?

Ola’s road to profitability: What lies ahead for one of India’s favorite unicorns? https://qwixpert.com/wp-content/uploads/2023/07/Microsoft-stock-image.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary Very few businesses can lay claim to changing the habits of a population. Ola, with its convenient and…

Medical Devices and Consumable: A Sunrise Sector with Lucrative Opportunities and Unique Challenges

Medical Devices and Consumable: A Sunrise Sector with Lucrative Opportunities and Unique Challenges https://qwixpert.com/wp-content/uploads/2023/07/Title-image.jpg 601 459 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The pandemic hit India in February-March 2020 setting the healthcare industry in overdrive. Patients needed treatment for a…

How can the Indian API industry grow rapidly and compete in the global market?

How can the Indian API industry grow rapidly and compete in the global market? https://qwixpert.com/wp-content/uploads/2023/07/1.-Title.png 931 616 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The Indian Pharmaceutical Sector is expected to grow to Rs. 7,371 Billion by 2025 from the current Rs.…

Indian B2C Digital business landscape

Indian B2C Digital business landscape https://qwixpert.com/wp-content/uploads/2023/07/Picture9-scaled.jpg 2560 1707 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDigital in numbers, but not the numbers corporate India is used to seeing In this day and age, yesteryear business…

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them

Key imperatives in the Indian Made Foreign Liquor industry today and trends driving them https://qwixpert.com/wp-content/uploads/2020/09/4.1_Industries_Alcoholic-beverages-1024x442-1.jpeg 1024 442 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary Per-capita alcohol consumption has seen an almost 3 fold increase since 2005 in India. A young population with…

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery?

How digital and e-commerce are moving the restaurants beyond the physical real estate and how this is the path to recovery? https://qwixpert.com/wp-content/uploads/2023/07/Page-1_Image.jpg 1379 916 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive Summary The coronavirus pandemic and the subsequent lockdown has crippled the foodservice industry. With operational constraints and an increase…

Simple ideas to improve warehouse efficiencies

Simple ideas to improve warehouse efficiencies https://qwixpert.com/wp-content/uploads/2023/07/Warehouse-1536x1024-1.jpg 1536 1024 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gDear Supply Chain Head, Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across…

Why a business case approach, to costs of owning an IPL team, is more prudent?

Why a business case approach, to costs of owning an IPL team, is more prudent? https://qwixpert.com/wp-content/uploads/2020/04/Picture28.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary In the previous article, the major revenue streams – Central Rights income, Sponsorships, Match day incomes were detailed…

Leveraging analytics to increase sales conversions and improve lead sourcing

Leveraging analytics to increase sales conversions and improve lead sourcing https://qwixpert.com/wp-content/uploads/2023/07/3.2_Services_sales-and-marketing-e1571141506341.jpg 1171 390 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary Lead prioritization model is a predictive algorithm to score and classify leads. Primarily used by sales organizations to…

How do IPL teams make money?

How do IPL teams make money? https://qwixpert.com/wp-content/uploads/2023/06/Cricket-Bat.jpg 1080 720 qwixpertadmin https://secure.gravatar.com/avatar/392f1042eaff5c1f343a179d15026010?s=96&d=mm&r=gExecutive summary IPL is now among the top 10 leagues in the world by broadcasting revenue. For a brand which…