Executive summary

The migration to Electric Vehicles from Internal Combustion Engine technology has gathered pace. Customer anxieties over their purchase and usage, while they remain, are declining. Regulatory authorities, manufacturers, and investors have set themselves ambitious targets and work in overdrive to achieve them. Players across the automotive value chain are facing disruption. Adoption and migration to the new normal are critical to avoid obsolescence. Manufacturers will need to diversify their portfolio, invest in R&D and capability development, cooperate with competition to overcome product obsolescence or end up being upstaged by new-age competitors. Regulatory impetus, a significant reduction in the number of moving parts, and lower cost of ownership will drive manufacturers to innovate through value engineering. More than 90% import of EV components as of date presents opportunities for local substitution. India must continue its global leadership in automotive manufacturing by investing early in EV. Loss of jobs and livelihoods expected across OEMs and OES. The Government needs to step-in with a holistic plan, including revamping the current educational system, to secure careers and develop an EV-specific talent base. Global geopolitics may shift from the Gulf to South America if and when Lithium becomes to new oil.

Electric vehicles technology is disrupting the entire automotive value chain

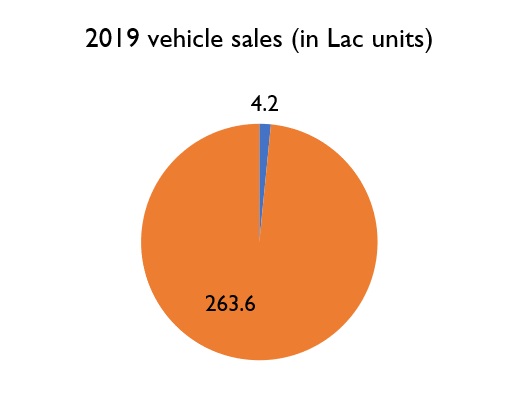

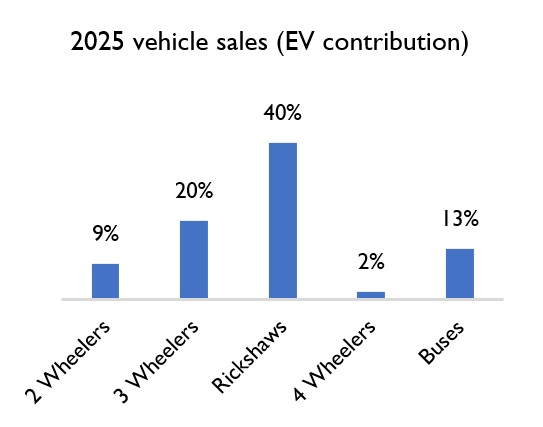

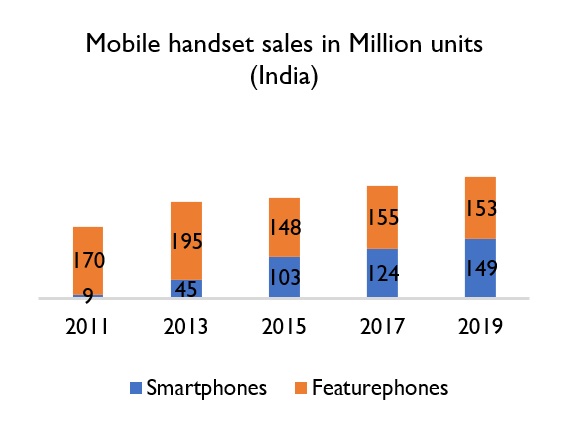

A decade ago, feature phone manufacturers overlooked the disruption from smartphones. The 16x sales growth of smartphones over a decade and a ~50% market share (in 2019) in the mobile handset category (Fig. 3) shares lessons for the automobile industry. The $118 bn automobile industry, contributing to around 7% of the Indian GDP, is expected to contribute over 35 million jobs to the Indian populace. Further, auto exports contribute to Rs. 1.0 lac Cr. earned in foreign currencies. This industry is facing disruption from green/energy-efficient technology, with Electric Vehicles leading the charge. The electric vehicles industry is estimated to grow to Rs.50,000 crores opportunity by 2025. Significant interest is noticed in this relatively nascent market, even as electric vehicles contributed to ~1.5% of the total vehicle sales in 2019. Avendus Capital, in its recent report, expects the contribution from 3W, buses, and 2W to drive adoption soon (Figs. 1 & 2).

Fig 1: Electric vehicles sales (units) – 2019

Fig 2: Key categories for EV sales by 2025

Fig 3: Mobile handset sales Year on Year

The migration to Electric Vehicles is currently slow but expected to disrupt players across the automotive value chain – Manufacturing and Sales & After-sales

Manufacturing includes Original Equipment Manufacturers (OEMs), their suppliers (Tier-1 OES), and their suppliers (Tier-2, Tier-3, and Raw Material manufacturers). Sales & after-sales include many players such as dealerships, energy infrastructure partners, financiers, authorized service stations, unorganized road-side mechanics, spare parts sellers, and branded/unbranded used vehicle network. Customers and regulatory bodies wield considerable influence on each of these players and accelerate or dampen the pace of disruption. In a 2-part series, Qwixpert will elaborate on the key trends, their implications across the value chain, and recommended responses for sustained business performance.

Portfolio diversification, capability development, and product innovation are critical for manufacturers to stay ahead in the EV revolution

- Technological readiness and upskilling are imperative for success in the EV era

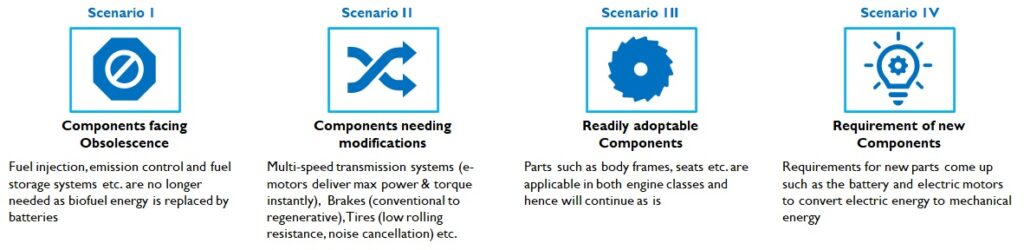

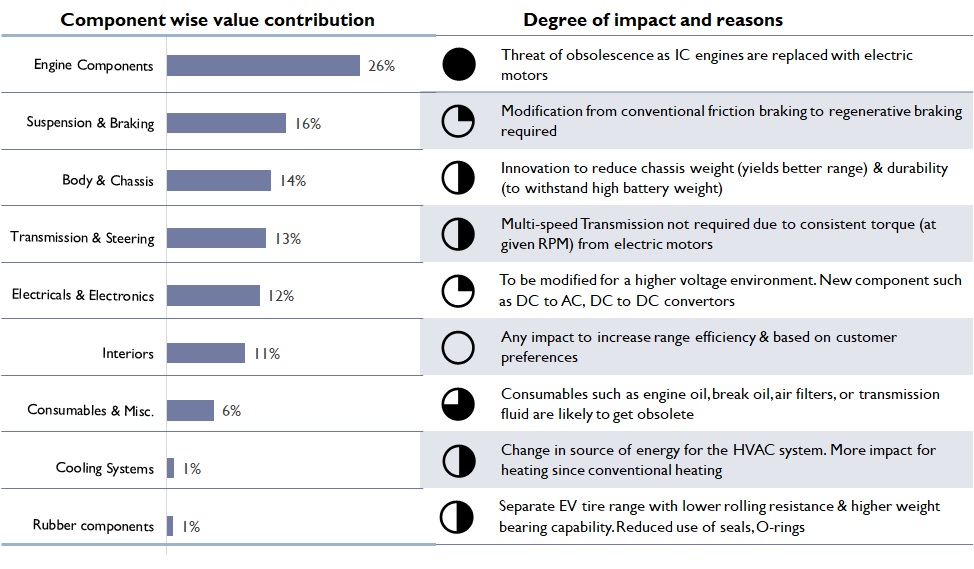

Electric vehicles are much simpler than their Internal Combustion Engine (ICE) counterparts. As per Avendus’ research, a typical EV has 24 moving parts compared to ICE’s 150 moving parts. A comparison between the two technologies highlights four scenarios. (Fig 4)

Fig 4: Four scenarios due to changing automobile technology – ICE to EV

Firstly, several parts are expected to become obsolete. The injection, emission control, and fuel storage systems are no longer needed as batteries replace biofuel energy. Secondly, existing parts may undergo modifications, as multi-speed transmission systems as electric motors deliver power instantaneously. Conventional brakes are to be replaced by regenerative brakes. Tire manufacturers are modifying their designs to develop lower rolling resistance and noise generation. Thirdly, new parts’ requirements come up, such as the battery and electric motors to convert electric energy to mechanical energy. Finally, parts such as body frames, seats, etc., are applicable in both engine classes and will continue.

Fig 5: Impact of EV adoption for each of the auto components

Indian Government has an ambitious vision of ensuring 100% EV by 2030. The implications of these possibilities are currently minuscule due to the low contribution of electric vehicles to the overall automotive sector. The impact of even a 10% migration in vehicle sales to EV will be substantial as the automotive industry employs over 7 million people (2 million by OEMs, 5 million by component manufacturers). There are an additional number of people involved in service stations and dealership networks as well.

The projected impact is twofold. Primarily, product obsoletion will precipitate business closures. MSMEs involved in supplying to Tier-2 and Tier-1 vendors of OEMs will need to shut shop unless a technology migration path to EV is set-up. Secondly, new and modified auto components require new skills. Lower moving parts also indicate automation opportunities, leading to job losses among the semi-skilled or unskilled labour force. There is a compelling need for holistic upskilling to create a sustainable supply of high skilled labour. The Government must ensure new courses and upgrading existing syllabuses of colleges, institutes, and polytechnic centres. In the near-term, manufacturers must spend on upskilling their workforce to remain increasingly relevant.

Auto component manufacturers investing in upskilling and R&D to deliver cutting edge product innovation are expected to succeed in the EV era. Suppliers dependent on principals’ designs to operate a cost-efficient production unit will need to engage principals for business sustenance.

- White spaces emerge due to high import dependence; Co-opetition a must among manufacturers

Auto component suppliers must assess their portfolios on the extent of exposure of obsoletion. The suppliers must actively integrate product mix diversification into their business plans to ensure long term business solvency. Companies can also go aggressive in identifying white spaces and quick wins (products with greater synergy with an existing portfolio, good market size, a higher degree of import substitution, and low investment activity at present). The majority of the EV parts (>90%) are imported today due to a lack of manufacturing infrastructure and skill gaps. Products such as the battery, chargers, electronic controllers, power converters, electric motor, and transmission are mostly imported, and these contribute to more than 2/3rd of the cost of an EV. Such import dependency presents a massive import substitution opportunity, especially for early movers. Indigenous OEMs and OES can partner with global EV leaders to fill technological and skill gaps. The Exide-Leclenche JV and Amara Raja-Gridtential Energy partnership are examples in this regard.

Platform approach in passenger vehicle development needs to be extended to electric vehicles to drive down initial costs and encourage faster adoption. Volkswagen has created a 4W EV platform called MEB and has extended it across its subsidiaries such as Audi, Skoda, and Volkswagen. The CMF-EV platform is an extension of Renault, Nissan, and Mitsubishi’s partnership to its Electric Vehicle range. Cooperation among OEMs at a scale never seen before is expected. The platform approach will help faster implementation of technologies such as battery swapping. Anxiety among customers w.r.t adequate post-purchase support catalyzing the pace of adoption. Platform approach and co-opetition to standardize components (especially battery) also support adoption.

- New raw materials and battery technology present lucrative investment opportunities

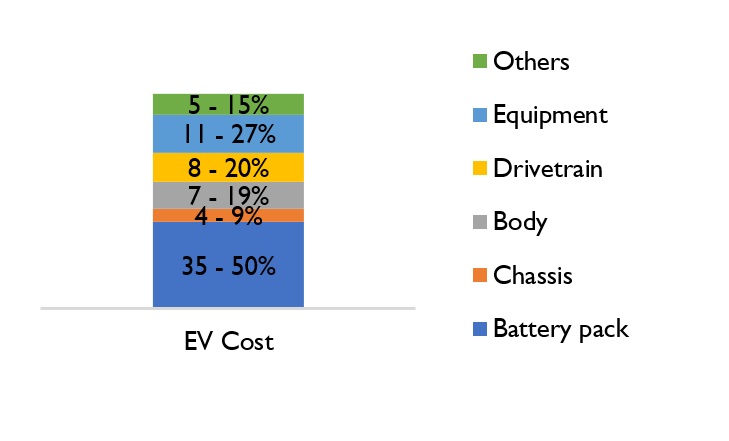

Batteries can make up as much as 50% of the EV cost (Fig 6). Several studies link the lower-paced adoption of electric vehicles to the higher initial cost, and battery technology is intricately connected to the demand. The cost of battery has come down from > $1,100 / kWh in 2008-09 to $156 / kWh in 2018-19. The inflection point for widespread adoption is expected to be $100 / kWh—the experts time this between 2022 and 2025.

Fig 6: Cost of individual components in an EV

China, Korea, and Japan control ~95%+ of global battery production. Countries across the globe are encouraging investments with incentives and subsidies. Manufacturers setting up new facilities in India can expect incentives of up to $25 / kWh. 3 Li-ion battery units with a combined capacity of 10 Gigawatts are expected to be set-up in Telangana with a total investment of Rs. 6,000 Cr. A phased increase in import duties of battery components from 5% to 15% will hasten battery manufacturing indigenization.

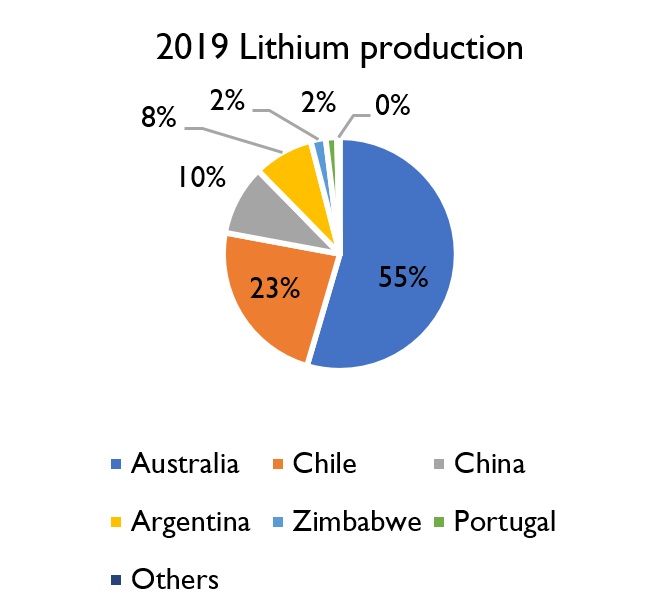

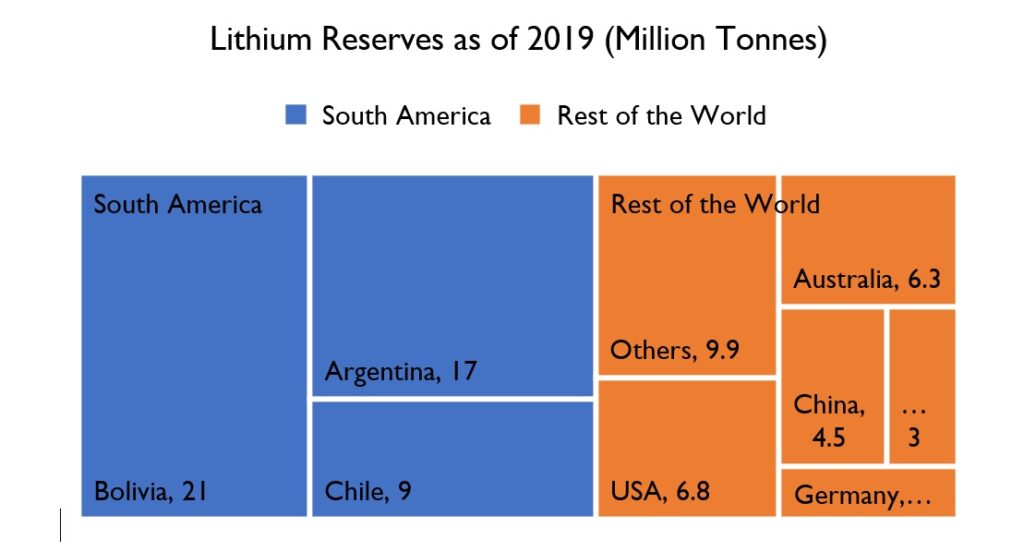

Crude oil prices are seeing a declining trend and are expected to continue in a downward trajectory. Experts across the globe believe the coronavirus pandemic may have accelerated a global energy transition away from oil. Asset write-offs worth $22Bn from Royal Dutch Shell and $17.5 Bn from BP in Jul’20 highlight the hastening pace of decarbonization across the world. Mainstreaming electric vehicles will create massive spikes in demand for raw materials such as Lithium, Cobalt, Manganese, etc., integral to manufacturing rechargeable batteries. The global focus may move away from the gulf to the top Lithium producing countries such as Australia, Chile, and China (Fig. 7). Analysis of the known reserves indicates a prospective geopolitical shift from the Gulf to South America (Fig. 8), if and when Lithium becomes the new oil.

Fig 7: Lithium production across the world

Fig 8: Lithium reserves across the world

Another key trend is suppliers’ investing in value engineering to increase vehicle range by making it lighter using Fibre Reinforced Plastics (FRP) for chassis. Tyres are also undergoing redevelopment to lower rolling resistance without compromising safety and increase fuel efficiency. Disposal, however, is a concern. Less than 5% of all spent Li-Ion batteries are recycled. FRPs cannot be reused, and higher costs of Lithium recycling (vs. mining for new Lithium) has led to inefficient disposal (landfills) with potentially harmful environmental effects.

Further, recycling is essential to harness rarer metals such as cobalt to avoid shortages during widespread adoption. Companies such as Redwood Materials, set-up by Ex-Tesla employees, are hence building recycling and disposal solutions. Current regulations around Li-Ion battery recycling are nascent and do not put the onus on manufacturers, unlike the food packaging industry. If it develops in the future, such a scenario may increase the initial cost to the customer.

Conclusion

Electric vehicles’ impact in the automobile industry is expected to be similar to that of smartphones in the mobile handset industry. Despite Electric Vehicles contributing to only 1.5% of total vehicle sales in 2019, the manufacturing circles are abuzz. With a 50% reduction in moving parts, several Tier-1, 2, and 3 suppliers must assess and diversify their portfolios to future-proof their businesses. More than 90% of the electric vehicle parts are imported, creating massive opportunities in import substitution. However, technology partnerships and rapid upskilling are critical. Early movers are set to gain massively as the Government offers subsidies and increases duties to enable indigenization. Co-opetition through a platform approach for vehicle and component development will benefit the entire manufacturing ecosystem. As battery costs make up 35% – 50% of total vehicle cost, countries with natural Lithium reserves are set to gain. Value engineering to reduce costs and improve vehicle performance are expected to continue as customer anxiety over higher initial investment acts as a key barrier to migration. India must act fast to offer cost-efficient and high-quality manufacturing options to Electric Vehicle players across the world.

Authors: Giridharan Raghunathan, Maheswaran Ganapathy and Rahul Das

Sources:

- Kusnetz, Nicolas (2020) “BP and Shell Write-Off Billions in Assets, Citing Covid-19 and Climate Change”, 2-Jul. Available at: https://insideclimatenews.org/news/01072020/bp-shell-coronavirus-climate-change

- NS energy staff writer (2020), “Profiling the top six lithium-producing countries in the world”, 23-Nov. Available at: https://www.nsenergybusiness.com/features/top-lithium-producing-countries/

- Kohli, Pratati Chestha (2020), “Opportunities in EV battery and cell manufacturing in India”, 2-Jul. Available at: https://www.investindia.gov.in/team-india-blogs/opportunities-ev-battery-and-cell-manufacturing-india

- James Eddy, Alexander Pfeiffer, and Jasper van de Staaij (2019), “Recharging economies: The EV-battery manufacturing outlook for Europe”, 3-Jun. Available at: https://www.mckinsey.com/industries/oil-and-gas/our-insights/recharging-economies-the-ev-battery-manufacturing-outlook-for-europe

- PTI (2019), Government notifies phased import duty hike on electric PV parts, lithium-ion cells, 11-Mar. Available at: https://economictimes.indiatimes.com/news/economy/foreign-trade/government-notifies-phased-import-duty-hike-on-electric-pv-parts-lithium-ion-cells/articleshow/68363381.cms?from=mdr

- Kia official website. Available at: https://www.kia.com/dm/discover-kia/ask/do-electric-cars-have-transmissions.html#:~:text=Electric%20cars%20don’t%20require,RPM%20within%20a%20specific%20range

- SIAM website. Available at: https://www.siam.in/statistics.aspx?mpgid=8&pgidtrail=9

- India Electric Vehicle Market Overview Report, Indiaesa.info. Available at: https://www.indiaesa.info/media/downloadfiles/EV_Report_Brochure._234429529.pdf

- Electric Vehicles, Charging towards a bright future, Avendus. Available at: https://www.avendus.com/india/ev-report

- Bajwa, Nehal, InvestIndia. Available at: https://www.investindia.gov.in/sector/auto-components

- Craftech Industries. Available at: https://www.craftechind.com/fiber-reinforced-plastic-in-action/

- Michael Friesa, Mathias Kerlera, Stephan Rohra, Stephan Schickrama, Michael Sinninga, Markus Lienkampa, Robert Kochhan, Stephan Fuchs, Benjamin Reuter, Peter Burda, Stephan Matz, Markus Lienkamp, “An Overview of Costs for Vehicle Components, Fuels, Greenhouse Gas Emissions and Total Cost of Ownership Update 2017”. Available at: https://steps.ucdavis.edu/wp-content/uploads/2018/02/FRIES-MICHAEL-An-Overview-of-Costs-for-Vehicle-Components-Fuels-Greenhouse-Gas-Emissions-and-Total-Cost-of-Ownership-Update-2017-.pdf

- Linda Gaines, Kirti Richa and Jeffrey Spangenberger (2018), “Key issues for Li-ion battery recycling” 22-Nov. Available at: https://www.cambridge.org/core/journals/mrs-energy-and-sustainability/article/key-issues-for-liion-battery-recycling/F37D3914A1F5A8FD0ED3EF901664D126

- Dutta, Arnab (2019), “India’s handset industry may go past the 300-mn unit mark in 2019”, 10-Jul. Available at: https://www.business-standard.com/article/companies/india-s-handset-industry-may-go-past-the-300-mn-unit-mark-in-2019-119010401162_1.html

- Pathak, Tarun (2017), “Mobile handset market in India”, 29-Nov. Available at: https://indiaincgroup.com/mobile-handset-market-india/