Executive summary

Very few businesses can lay claim to changing the habits of a population. Ola, with its convenient and cost-effective cabs, has changed how India travels. However, the business is yet to sustain itself financially. With the increasing customer acquisition cost for their 4W intra-city taxis and the need to turn profitable, Ola ventured into more cost-effective mobility options (carpooling, autos, 2 wheelers). Recent numbers on # of rides per day show a certain stagnation – 3.5 million/ day in 2018 vs. 3.65 million/ day in 2019. A slew of regulations issued by the Road Transport Ministry aims to limit aggregator commissions to 20%, surge pricing to 1.5X, increase formalization of the workforce (drivers), and ensure driver and rider safety. These measures squeeze Ola’s margins on either side. Hence, the road to profitability has to take two paths – premiumization of existing offerings and efficiency in operations. 4 solution themes, Driver marketplace, Electric Mobility, Strategic Partnerships, and Analytics for premiumization, present themselves. There is significant value in investing in all four, as our analysis show.

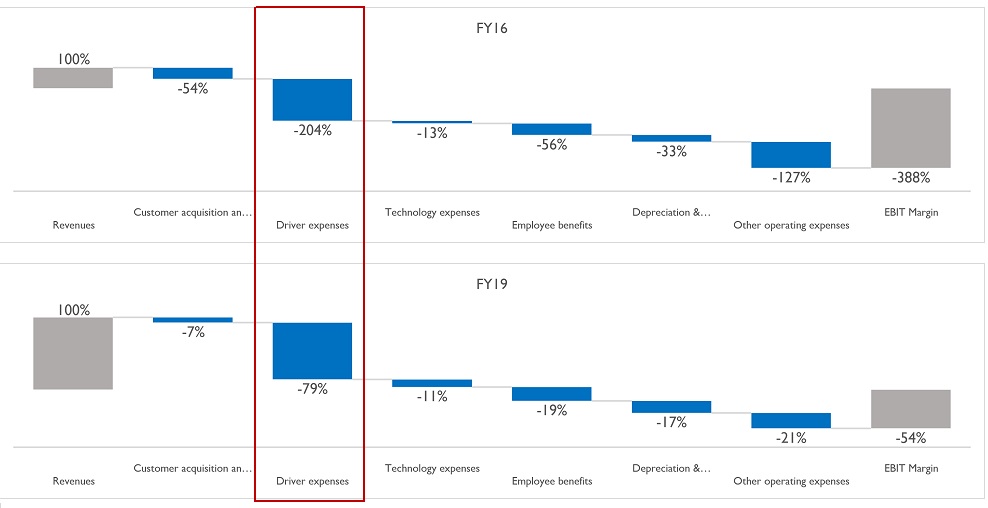

Ola’s growth is staggering with several cost elements in check or along the path; Driver expenses as a proportion of revenues are the focus for profitability

The disruption in cab-rentals in India with the arrival of Ola in 2010 and Uber a few years later is well known. Their aggregator business model with an attractive combination of convenience and economic value for riders and the driver-partners has potentially changed riding habits for generations to come. Industry estimates indicate that Ola and Uber offer ~3.65 million rides every day, i.e., more than a billion rides every year.

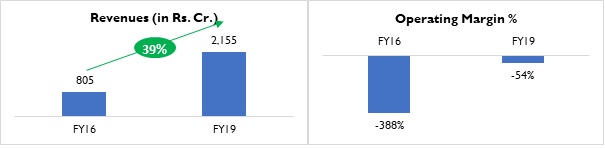

Billions of rides every year offered by 2.5 million driver-partners is no small achievement. But for any business to sustain, it must be profitable. A glance at the FY19 financials for ANI technologies indicates that the Operating Margin is -54% (Fig 1). A comparative analysis of the same metric in the past suggests the Operating Margin has improved from -388% in FY16. The result has come on the back of a tremendous CAGR of ~39% in revenues (Fig 1).

Fig 1: Revenue and Operating margin – FY19 vs. FY16

Ride-hailing services have 5 primary operating costs (Fig 2)

Fig 2: ANI Technologies – Key Cost elements

Qwixpert team analysed the trajectory of each of these cost components for Ola (Fig 3). Sharp decreases in all cost elements indicate significant cost-cutting and efficiency improvement measures. “Driver expenses” remain critical to profitability.

Fig 3: ANI Technologies Operating margin waterfall (all values in % of revenues) – FY19 vs. FY16

Ola, in early 2020 decided to cap driver incentives to 5% of earnings, stating that the previous system, based on trips and logins, was seen as arbitrary and not to the liking of drivers. Commissions charged by Ola (i.e., Ola’s revenues) were simultaneously capped at a fixed 20% to ensure clarity among the driver community on their estimated daily and monthly earnings. These moves have led to driver’s earning falling, leading to lower cars on the road. This move could potentially manifest into a downward spiral with lower vehicles on the road, increasing waiting times for customers and hence higher churn, further impacting driver earnings.

Regulatory oversight into ride-hailing has increased. Parliamentary panels and Road Transport ministries have acted on appeals and complaints from the driver and rider community. New guidelines issued impact current margin improvement methods. Capping surge pricing, aggregator commissions (as a % of trip revenues), and the number of driving hours per day restricts earnings potential. Compliance with guidelines of daily driver log-in hours and social security benefits to drivers will increase costs.

The most critical dilemma that ride-hailing companies are trying to solve – Increase revenues and minimize driver expenses proportionate to incomes – has become more difficult.

Qwixpert explores four potential solution themes to achieve these twin objectives

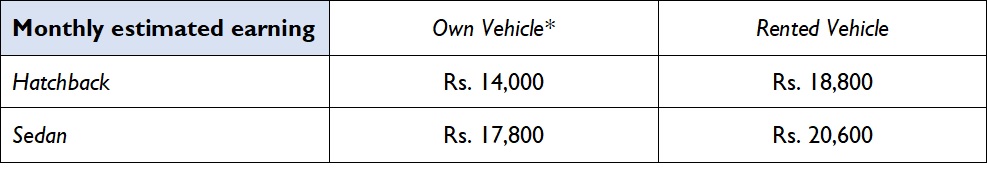

It is extremely crucial to understand the earnings profile of a ride-hailing driver. Considering a city taxi in an urbanized set-up like Delhi-NCR, where the driver works for 25 days in a month and is driving ten effective hours/ day, we have estimated earnings across 4 scenarios. In each of these scenarios, no additional incentives have been considered. A 3-year loan repayment period is considered, while the resale value is not included in the business case calculations.

Fig 4: Monthly earnings estimate for drivers-partners (w/o incentives)

Driver availability throughout the day and across locations is a key challenge. Hence, to incentivize drivers to stay logged in for longer and take those extra rides, bonuses based on total rides/day were introduced. The incentive system is neither sustainable financially for Ola nor safe for its riders (drivers staying on the road for long hours).

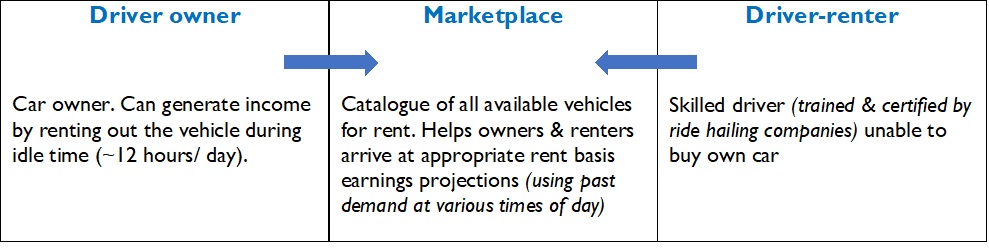

Getting new drivers on board to match the aggressive growth targets is also a challenge. High sign-up bonuses encourage drivers to take vehicle loans. Many drivers are unable to pay their EMIs as their loans are from local financers, charging high-interest rates. A marketplace model (Fig 5) will be useful in such a scenario.

Fig 5: The marketplace model

Since Ola allows multiple driver tagging to the same Vehicle (but only one at a time), smart fleet owners already use this model to maximize asset (taxis) utilization. Concerns regarding vehicle safety can be ensured by taking a security deposit from the 2nd driver and training and certifying driver-renters using Ola Skilling. Rent and/or revenue sharing models can be estimated using analytics.

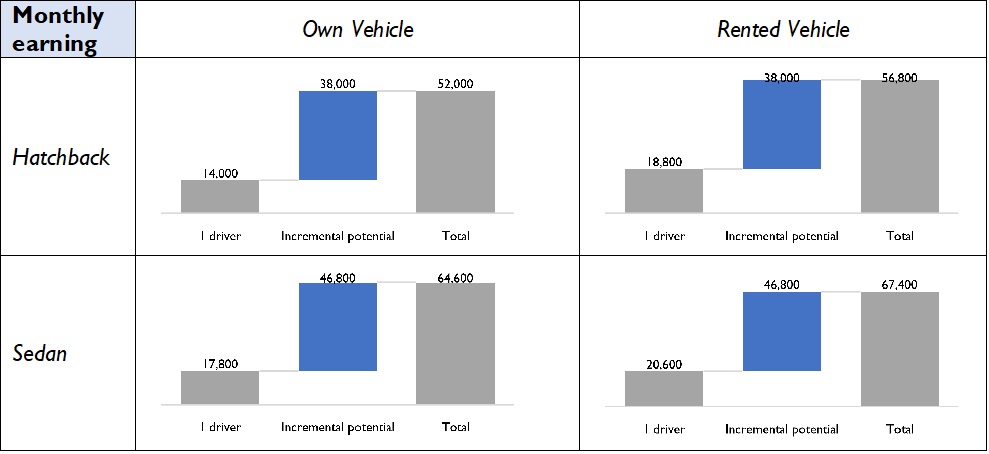

Fig 6: Monthly earnings estimates for driver-partners (w/o incentives) – 2 drivers/ car

Qwixpert estimates a 200-270% increase in monthly earnings from a car through the marketplace model (Fig 6), as fixed costs of owning a car (Eg: EMI, taxes, Insurance) get apportioned over a larger revenue base. The marketplace model is a win-win for all: consumers (higher levels of service), drivers (higher incomes), and the aggregators (increased market access and reduced incentive payments).

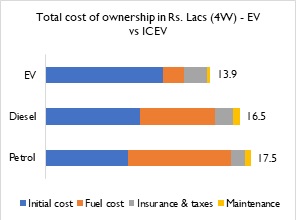

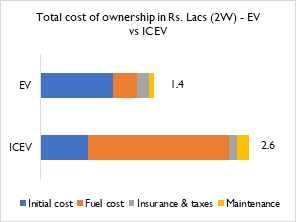

Total Cost of Ownership (TCO) analysis of EVs vs. ICEVs (Figs 8 & 9) for 4 wheelers and 2 wheelers indicates higher life-time value for the taxi segment, especially Taxis driven for longer distances every day. With the impetus from the Government to push EV adoption through subsidies, grants, and infrastructure-focused stimuli, EVs can generate significant earnings for the aggregators and the driver-partners.

Fig 7: TCO for 4W Sedan running ~150km/ day for 3 years

Fig 8: TCO for 2W running ~100km/ day for 3 years

Ola’s strategic investment in Ola Electric Mobility is a step in this direction. A spate of investments from existing investors (Softbank and Tiger Global) and Global Auto OEMs (Hyundai and Kia) has made Ola Electric Mobility a Unicorn in its own right. Outside of investing in an all-electric vehicle fleet of cars, 2-wheelers, and autos, Ola electric is investing in support infrastructure, i.e., battery-swapping and charging stations. EV fleet can also be integrated into the marketplace model with a substantial increase in returns.

There are lots of synergies to be generated from strategic partnerships with hospitality services. Meru has tied up with MakeMyTrip (Fig 9) and is jointly promoting their cabs at airports through messages and email to customers who have booked tickets on MakeMyTrip. Their prompts across communication channels help reduce the traveler’s wait time once he/she lands. This example can be extended to other aggregators such as Zomato, where a customer booking a table at their favorite restaurant can be prompted to book a cab then and there. Analytics can be leveraged to prompt the rider after a reasonable amount of time, basis the type of destination, to book the return-cab. Partnership opportunities exist with BookMyShow, Booking.com, and other services of similar nature. Swiggy has also leveraged this synergy as customers booking an order are now given the option to watch a Netflix movie trailer.

Fig 9: Meru–MakeMyTrip partnership

The alternative approach to proportionately reducing driver expenses is increasing revenues. The concept of surge pricing combines analytics with demand-supply economics. Incentivizing drivers who brave harsh weather and traffic conditions with higher fares and commanding a premium from customers for operating taxi services in such conditions are the key notions behind surge pricing. Likewise, ride-hailing services have also leveraged advanced analytics to ensure maximum driver availability at high demand routes, maximizing a driver’s earning potential and minimizing waiting times for riders. Qwixpert estimates several other applications, as below

Conclusion

Outlook for mobility is muted now, especially with work from home continuing to be the norm in the service sector. However, with the active COVID-19 cases falling and several vaccines showcasing promise in 3rd stage trials, vehicular movement is expected to return to pre-COVID levels soon. Ola’s dream of turning profitable may not have materialized yet, and the COVID-19 pandemic has set them back by another year, if not more. But analysis of their financials indicates that they are on the right path. Besides, recent guidelines that limit earnings and increase costs will further impact profitability. Therefore, it is critical to look at long-term initiatives that focus on leveraging operational efficiencies and premiumization of services through incremental customer value. The four solution themes discussed – driver marketplace, electric mobility, robust data analytics, and strategic partnerships – can drive these objectives and achieve sustainable profitability.

Authors

Giridharan Raghunathan and Rahul Das

Sources:

Minchin, Joshua (2020), “Ola and Uber face new regulations in India” Nov-30, Available at: https://www.intelligenttransport.com/transport-news/112231/ola-and-uber-face-new-regulations-in-india/

Dear Supply Chain Head,

Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across the supply chain: workforce shortages, transport issues, government plans, demand and supply fluctuations. While there are discussions and speculations about the future, companies must undoubtedly focus on reducing cost, improve efficiencies, and manage their working capital well in the next 12 – 18 months, to emerge stronger out of this crisis.

The purpose of this series is to provide simple but effective ideas to help managers improve elements of their supply chain. In this post, I share a few ideas for enhancing warehouse performance.

It is becoming a challenge for e-commerce and consumer goods companies to fulfil orders due to the non-availability of resources in their warehouses, first and last-mile distribution. The labour shortage situation will take considerable time to improve as a lot depends on when the migrant workers can return from their native. Also, the requirement of social distancing, if implemented well, will slow down processes and productivity levels. The onus is on the supply chain managers to not just resume warehouse operations well – with all the safety protocols but also to improve productivity levels to meet mid to long term goals of the businesses. Here are a few ideas to consider:

Depending on your industry and warehouse operations there could be more ideas ,but 20 – 25 % improvement in productivity is achievable. The key is to identify opportunities, spend time on planning now, and start implementing soon after operations resume.

I look forward to hearing your views on the above ideas and some more ideas if you would like to add.

In the next post, I will discuss the challenges and potential improvement opportunities in the logistics and transportation side of the supply chain.

– Rajan Ekambaram, Partner, Supply Chain Practice Qwixpert

In the previous article, the major revenue streams – Central Rights income, Sponsorships, Match day incomes were detailed and compared with mature leagues across the globe (Premier League, NBA, NFL, etc.). Growth opportunities were identified and enumerated. This article, discusses the 3 major expense streams – player fee, BCCI commission & other commission expenses. The critical question every franchisee faces with each cost element is the trade-off between the expense and its potential income generation capability. This article highlights these associations and integrates a business case approach to decision making on cost optimization.

Franchises on an average spent around ₹430 crores1 ($90 million) to bid and purchase an IPL team 12 years ago. They come from backgrounds previously unconnected to cricket, the sports growing profile & popularity in the country testified a long-term investment. The business strategy to own a team varied across the franchises.

Brand extension to the original business. Reliance used the platform to launch the brand in the sports industry. Vijay Mallya wanted to link the team to either Royal Challenger or McDowell no.1 for surrogate advertising to meet the Advertising Standards Council of India (ASCI). India Cements built marketing programs on the CSK- India Cements connection. Sun TV network purchased Sunrisers Hyderabad from its previous owner Deccan group with a strategy to increase revenue and eventually sell a stake of the cricket team for profit2. This strategy has been seen globally – For example: In the Premier League, Venky’s chicken own Blackburn Rovers. Etihad is using the 10-year agreement with Manchester City FC to brand the sports arena in the city as Etihad Campus and further improve the airline business in the region through a new hub and airport. Many of the Japanese baseball leagues are owned by companies and bear the company’s name like Chiba Lotte Marines which is owned by the Lotte group.

IPL’s Entertainment value as a key to its success. The founders believed a large part of IPL’s success will depend on its entertainment value as much as its sporting value. This led to the two biggest box-office draws of the country – cinema and cricket combining. Several high profile actors and actresses either partly own franchisees or have been/ are endorsers of these franchisees ever since its inception3.

While, yes, these strategies do make business sense. The key question is, on a standalone basis, is owning an IPL a valuable business proposition? It is indeed the case. On average, IPL teams have a strong 24%4 EBITDA. In comparison, Premier league teams EBITDA is 17.8%5 while most of the teams in other nascent leagues like Pro-Kabaddi League or ISL are yet to make money.

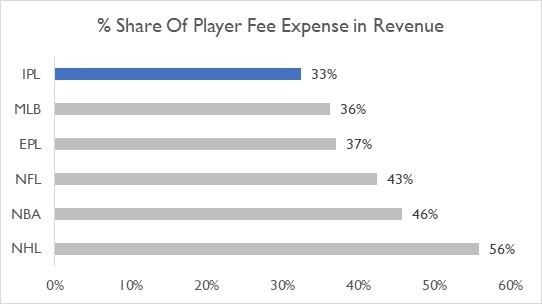

In comparison with other major global leagues, IPL’s player fee expense is the least. Most mature leagues like NFL, NBA & NHL spend >40%6 of their revenues on player fees

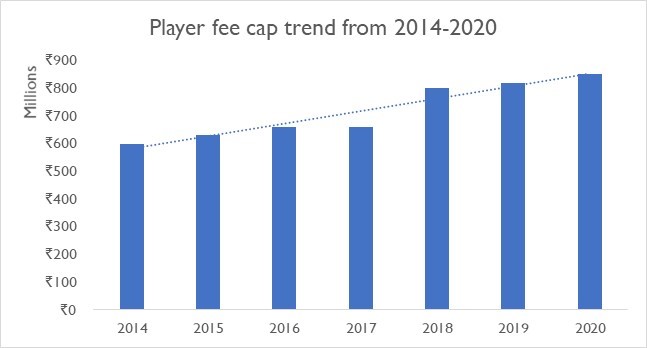

Since the first edition of IPL, there has been a cap on the total spend on players. Initially, the player fee cap was ~₹20 crores. Till 2014, the Indian domestic players were not included in the player auction pool and could be signed up by the franchises at a discrete amount while a fixed sum of ₹1 million (US$14,000) to ₹3 million (US$42,000)7 would get deducted per signing from the franchise’s salary purse. This received significant opposition from franchise owners who complained that richer franchises were “luring players with under-the-table deals”; following which the IPL decided to include domestic players in the player auction. In 2014, a strict overall team cap was set at ₹60 crores8 and grew around 3% per year. As shown in the chart below

| Avg. Growth Rate – 3% |

In 2018 the IPL- Star India broadcasting rights deal, generated a huge revenue and teams could afford to pay higher salaries. The BCCI increased the salary cap by ~21% (2017- 2018). In the 2020 edition of IPL, the team salary cap was ₹85 Crores9.

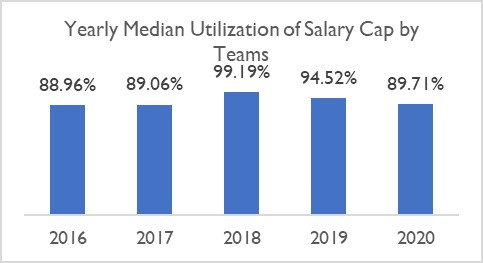

From 2015 to 2018, the median utilization of salary cap was ~88- 89%10 with RR, SRH, and KXIP below 83%. To ensure that teams spend a minimum portion of their budget on salaries and the general salary level increases, a salary floor was introduced in 2018, which increased the utilization to 99% in 2018.

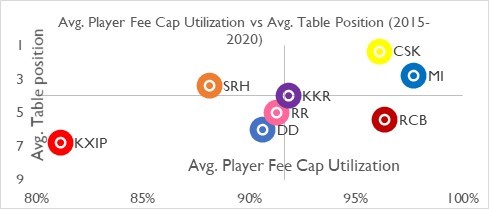

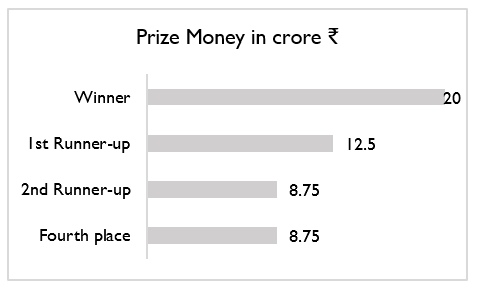

Basis table positions, SRH seems to have achieved the best balance with player salaries, it has spent ~88% of the allotted player fee over five seasons from 2015 to 2019 and secured an average table position between 3-4. This has monetary advantages as teams earn money basis table position (being in the top 4 list). SRH had won the 2016 season and secured runners-up in 2018. RCB, on the contrary, has spent more than 95% of the salary cap and has secured an average table position between 5-6. Till the 2019 season, the total prize money was ₹ 50 crores. Winner getting ₹ 20 crores, runner-up ₹ 12.5 crores and 3rd & 4th getting ₹ 8.75 crores each. BCCI has decided to slash the prize money by half from the 2020 season11.

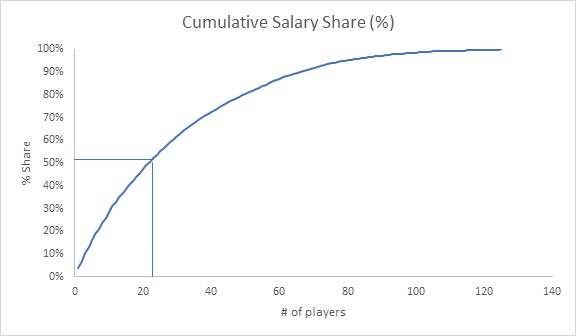

The distribution of budget across players tends to be rather unequal with a few highly sought-after players going for big bucks. The top 25 players get more than 55% of the salary share while the other 100 players share the remaining 45%. At a team level, ~50%12 of the salary cap is spent on the top 5 players.

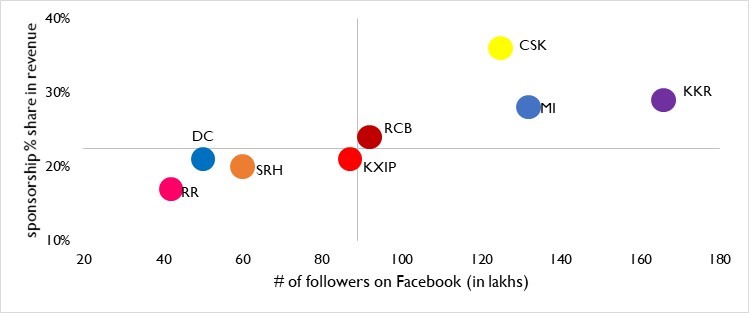

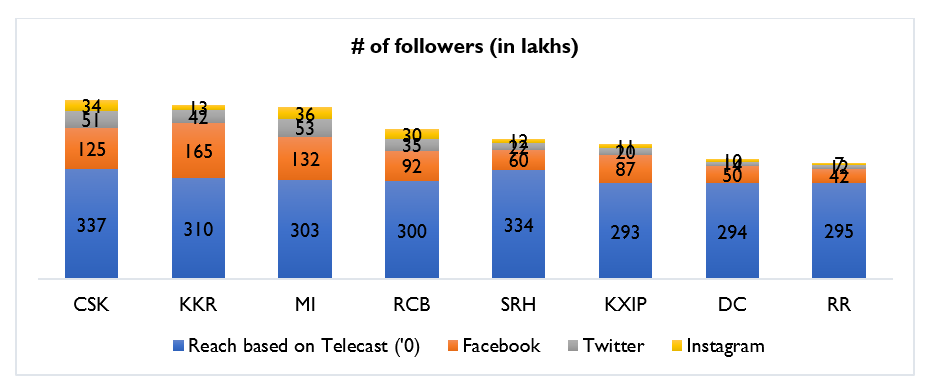

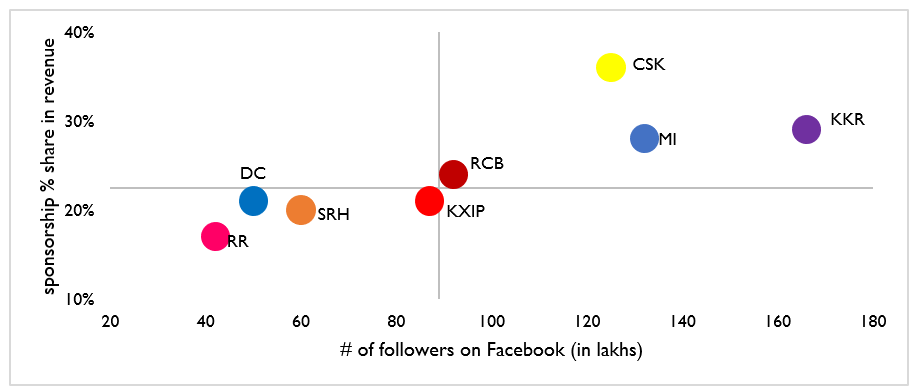

Franchises like CSK, MI, KKR & RCB spend a major share of the player fee to have popular players like MS Dhoni, Rohit Sharma, Kieron Pollard, Virat Kohli or AB de Villiers in the team. These teams have the highest number of followers and are generating more sponsorship revenue and stadium ticket utilization compared to the rest of the teams.

Players fees is indeed a major expense component as top players usually come with high salaries. But they can contribute in two critical ways to revenues – increased fan following (directly correlated to major revenue streams – sponsorships & ticketing income) and prize money. Teams have to be astute about rationalizing the spend on players as one my end up being penny wise and pound foolish.

IPL was supposed to be an auxiliary project of BCCI. It now makes 16 times13 more profit in the 45-day window than the rest of the year. Major sources of IPL revenue for BCCI are Broadcasting Rights & Media Rights and Franchise fee together contributes to more than 88% of the share and title sponsorship which is 10% of the share14.

BCCI accords 50% of the total revenue from media and title rights, and league sponsors to the franchises as central sponsorship. ₹200-250 crores from 2018-2023 i.e. till the Star- IPL deal is active. Before the deal teams were getting ~ Rs 65 crores. In return, they collect a franchise fee of 20% of their total revenue from the teams14.

Globally sports leagues are managed in two ways it can be a single business entity where the team owners are shareholders in the league. There are no individual owners or investors, with all teams centrally owned and operated by the league. The league, not the individual teams, have contracts with the players. It functions as a highly centralized structure. The support staff is shared between all the teams and a single entity takes care of all aspects of team activities: Marketing, Promotion, broadcast and Intellectual property. The teams are not bound by anti-competitive laws. The business is also easily transferable and the entire league can be sold as one asset. XFL football league operates in this model

The second type is a central association that franchises the ownership of a team usually based on locality. The franchises have the contractual rights to own and operate the team. Most of the major global leagues are based on this model. The premier league, NBA, NFL, La Liga and most of the Indian leagues such as Pro-Kabaddi, Super league, and the IPL. Most of the global leagues do not collect franchise fees from the teams. But IPL does. With the reduction in prize money, in the future will the franchises demand for reduction in commission rate or follow the global trend of no franchise fee?

Teams typically outsource stadium & stand décor expenses to third party agencies. The type and cost décor are directly proportional to the ticket price of the stand. Event management expenses include expenses such as brand signages, cheer girls, generators, licenses & permissions and security.

For selling tickets online on Bookmyshow or Ticketgenie teams have to shell out commissions to these agencies. To get the right sponsors teams generally, outsource the rights to get sponsors to experts and share a percentage with them.

The split of expenses between the three categories varies between the team. Typically, the majority of the spend is from event management expenses, followed by either ticket sales commission or sponsorship commission.

These expenses are important and have several indirect benefits. For instance, creating the right environment for the spectators in the stadium drives the ticket sales as well as TV viewership leading to increased sponsorship incomes and future auxiliary brand extension opportunities. Managing the sponsors, allocating right player and player times to each sponsor, keeping the franchise & sponsor engaged through the year builds a connection between the two and is crucial & beneficial for both the parties. Franchisees need to access professional help and look at this expense strategically. A smooth management of these functions keeps sponsors, players and fans happy, encourages loyalty and steady income generation. Decisions to curtail these expenses, should assess their impact on income and not solely be taken on the outflow.

Support staff fee is the largest component in these expenses, ranging between 3%- 4% of the revenue and has been in this range from a couple of years across the IPL franchises.

Stadium rent accounts for less than 1% of the revenue. Till the 2019 season, teams used to pay ₹30 lakhs/home match to the state association as rent to use the stadium. It amounts to around 1% of the expense for the franchise. From 2020, IPL Teams have to pay ₹50 lakhs/home match to the state association. The fee is used for the upkeep of the stadium, ground and other facilities by the state association. 15

While four of the 32 NFL teams have a home ground, the rest of the 28 teams pay rent to use the stadium16. A team plays 8 – 10 games at home out of the 16 games of the NFL regular season. The average annual rent is approximately $ 2 million, i.e. about ₹1.5 crores per match17. Of the 30 teams in the NBA, 12 teams own a stadium and 18 teams rent a stadium. In a season of NBA which is played over six months, each NBA team plays 41 games at home. All the 20 teams in the premier league own a stadium & play 19 games at home. An IPL team plays only 7 games at home and the calendar is only for 2 months leading to a stronger business case for renting over owning a stadium

Assessing the expenses indicate an inextricable link of each expense head to several revenue streams. There are significant skews to certain costs (eg: player fees) and some expenses seem unavoidable (eg: BCCI commission). It is hence prudent for a franchisee to pivot their views on these costs by focusing not on optimizing them but by maximizing their returns. Every cost element in a franchisee’s P&L hence needs to be evaluated with its associated business case with a view on long term benefits prior to investing in them or rationalizing.

1. CricInfo Staff (2008) ‘Big business and Bollywood grab stakes in IPL’ ESPN CricInfo 24 Jan Available at https://www.espncricinfo.com/story/_/id/20427511/ipl-announces-franchise-owners

2. Leena, S. Bridget (2015) ‘Sun TV open to stake sale in Sunrisers Hyderabad: CFO, live.com, 4 August. Available at https://www.livemint.com/Money/HQhby1MGaO9UFuukWeTE9O/Sun-TV-open-to-stake-sale-in-Sunrisers-says-CFO.html

3. Kholi, Rajeev (2011) ‘The Launch of Indian Premier League’ Columbia.edu, Available at http://www.columbia.edu/~rk35/IPL.pdf

4. Financial reports from MCA filings of company financials

5. Deloitte Report (2019) ‘Annual Review of Football Finance 2019’, Deloitte.co.uk, May. Available at https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/consumer-business/cz_annual_review_of_football_finance_2019.pdf

6. Sporting Intelligence ‘Global Sports Salary Survey 2019’. Available at https://www.globalsportssalaries.com/GSSS%202019.pdf

7. Wikipedia ‘Indian Premier League’ Available at https://en.wikipedia.org/wiki/Indian_Premier_League

8. ESPNCricInfo Staff (2013) ‘Player Regulation for IPL 2014’ ESPN CricInfo 24 Dec Available at https://www.espncricinfo.com/story/_/id/21581720/player-regulations-ipl-2014

9. Wikipedia ‘List of 2020 India Premier League Personnel Changes’ Available at https://en.wikipedia.org/wiki/List_of_2020_Indian_Premier_League_personnel_changes

10. Mishra, Aryan (2019) ‘IPL 2020: Complete list of all eight teams’ Inside Sports 20 Dec. Retrieved from https://www.insidesport.co/ipl-2020-complete-list-of-all-eight-teams/

11. BS Web Team and Agencies (2020), ‘IPL 2020 champions’ prize money to be cut as Indian cricket hit by slowdown’ Business Standard, 4 March. Available at https://www.business-standard.com/article/sports/ipl-2020-champions-prize-money-halved-as-indian-cricket-hit-by-slowdown-120030400392_1.html

12. Sportekz (2020) ‘IPL 2020 Player Salaries’ SportEKZ 24 Feb. Retrieved from https://www.sportekz.com/cricket/ipl-2020-players-salaries/

13. Basu Arani (2018) ‘BCCI set to earn over Rs 2000 crore from IPL’, Times of India, 13 Feb. Available at https://timesofindia.indiatimes.com/sports/cricket/ipl/top-stories/ipl-to-give-bcci-95-percent-of-its-surplus/articleshow/62894670.cms

14. Sharma, Rajendra (2018), ‘For once, each IPL Franchisee poised to earn 150+ Crore Profit’, Inside Sport, 2 May. Available at https://www.insidesport.co/ipl-franchisee-poised-%E2%82%B9150-crore-profit-0602052018/

15. Gollapudi, Nagraj (2020), ‘IPL halves play-off reward, hikes staging fee for franchises – owners object’, ESPN CricInfo 9 March. Available at https://www.espncricinfo.com/story/_/id/28872214/ipl-halves-play-reward-hikes-staging-fee-franchises-owners-object

16. Farmer, Drew (2019), ‘The NFL has 28 teams that don’t own their own stadiums’, Inside Sport, 8 Aug. Available at https://www.americabet.com/football/nfl/the-nfl-has-28-teams-that-dont-own-their-own-stadiums/

17. Las Vegas Review Journal (2017), ‘Stadium and rent details for all 32 NFL teams’, 6 March. Available at https://www.reviewjournal.com/sports/raiders-nfl/stadium-and-rent-details-for-all-32-nfl-teams/

Executive summary

IPL is now among the top 10 leagues in the world by broadcasting revenue. For a brand which is growing at an astonishing 22% year on year, Qwixpert explores the business behind the league. In 2 articles we wish to detail the financial business case of an IPL franchisee and what more can they do, to improve its lucrativeness. Here, in Part 1, the 4 major revenue streams – Central Rights income, Sponsorships, Merchandise sales and Match day incomes are delved into in detail and compared with mature leagues across the globe (Premier League, NBA, NFL etc.). While the much-improved central rights income has made every IPL franchisee profitable, teams need to continuously engage with fans outside the 2 month season while simultaneously addressing efficiency gaps and untapped opportunities in-season in line with global peers.

With a valuation of ~US $6 Bn, IPL is bigger than Ola, Swiggy and Oyo

For an Indian brand to have grown to ₹45,000 crores1 in 11 years sounds astonishing. That is precisely what the Indian Premier League (IPL) has done. IPL is now a household name and its brand value has been constantly on the rise. A recent report by Duff and Phelps indicates that IPL’s brand value is growing at ~22% YoY since 20141. Along with the league, franchisee brand values are also rising at an even pace. Mumbai Indians with a valuation of ₹810 crores and a growth of 7% over last year is the most valued franchisee 3rd year in a row. Kolkata Knight Riders (KKR) closely follows with a valuation of ₹746 crores1.

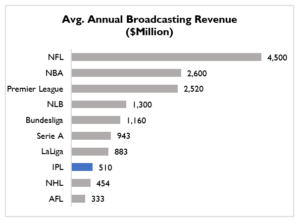

Graph 1: Average annual broadcasting revenue earned by top 10 leagues in the world

Any discussion about IPL begins with eye-popping broadcasting deal numbers – Star India’s contract with BCCI worth more than ₹16,000 crores for five years is as huge and has been a major contributor to the rapid growth of the league. This figure (~Rs. 3,200 cr. annually) pits IPL at No. 8 across all leagues globally as per data from ICICI securities2. This contract was four-fold more than the previous one of ₹800 Cr. with Sony pictures3 for 10 years.

Followed by tens of thousands at the ground every match and millions on screen, IPL is one of the most followed sports leagues across the globe

According to BCCI, IPL contributed to 0.6% of the Indian GDP4. BARC, which publishes viewership data, believes 462 million people watched IPL’s 12th season, up 12% from 2018. The finals between MI and CSK, was watched by a record 18.6 million simultaneously. With a total consumption of 338 billion minutes IPL 2019 was viewed for ~13% more minutes vs IPL 20185. IPL ranks fifth in the world in attendance for outdoor sports, with an average of 30,000 fans per match. And has a total attendance of 1.9 million for 60 games6.

Graph 2: Average attendance per game in top 5 international leagues

This massive viewership should not come as a surprise. The league is played during April and May when the schools are closed for the summer and during the evening prime time of 8PM. This has led to increased IPL penetration among women viewers while keeping its traditional base of kids and men intact. The fast-paced nature of the T20 game bringing together the best cricketers from across the world and popular movie stars as owners or ardent fans of franchisees have added to IPL’s ever-growing fan base.

Success of IPL depends on the success of its franchisees. While the franchisees are teams that fans root for, they are also business investments for their owners who evaluate not just league standings but also returns generated. To understand the success of IPL, it is therefore imperative to understand the financial performance of its franchisees.

In a 2-part analysis, we wish to break down these numbers – ones on their financial records to make sense of their valuations. Here we try to shed light on how franchisees generate revenue and what more can be done to further improve toplines.

Sports franchisees across the world have 4 major revenue sources and IPL is no different

Central rights income contributes to as much as 50% – 60% and has turned most franchisees profitable

As part of the revenue sharing agreement between BCCI and IPL franchisees, a portion of the broadcasting rights money from Star India is divided equally among franchisee teams. A part of the central sponsorship incomes is also divided among the franchisees. These are called central rights income and teams earn ~Rs. 200 – 250 Cr. annually.

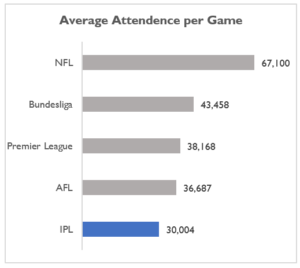

This revenue stream contributes to ~50%-60% of total topline. In comparison with other international leagues such as NBA, EPL or NFL where the share is 45%-55%. Further, this has helped all teams turn profitable from IPL 2018 – a first since the inception of the league. Analysis by ICICI securities2, as shown below, on Sunrisers Hyderabad and Delhi Capitals highlights the impact between the years of transition.

Graph 3: 2018 vs 2019 – Revenue and PBT comparison for Delhi Capitals (DC) & Sunrisers Hyderabad (SRH)

Sponsorship Income

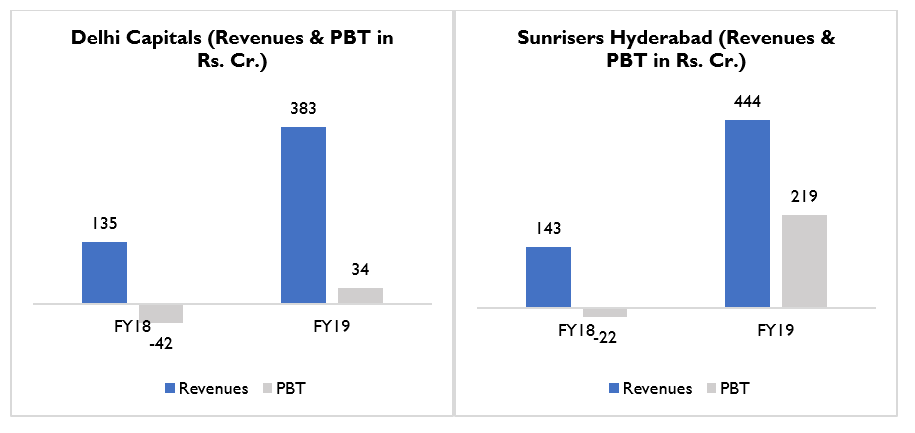

Any brand which wants to get associated with the teams and use players and other franchisee brand imagery pays “sponsorship fees”. This is the next biggest revenue source constituting 20% – 30% of the total. Qwixpert’s benchmarking exercise points to a similarity with major international leagues such as NBA, EPL or NFL who have a similar share (20%-25%). Franchisees can earn sponsorship through 4 key avenues, further classified into 11 sub-groups as shown below.

Figure 1: Eleven types of sponsorships in sports leagues

Financial express reports that in 2018, the total jersey sponsorship deal signed by all eight teams in IPL was in the range of ₹300-₹320 crores, growing by 44% over 2017. Mumbai Indians replaced its Jersey front sponsor Videocon with Samsung for ₹75 crores for three years8 (@₹25 crores each year). Same year CSK switched from Aircel to Muthoot Finance for ₹25 crores per year8. Comparatively, in the 2015-2016 season of EPL, revenue from jersey sponsorship was ₹1,820 crores. Case in point, Manchester United signed a seven-year deal with a US car manufacturer Chevrolet for a whopping ₹482 crores for branding on the front of jersey7.

Sponsors generally associate with franchises with similar brand imagery and target customer groups. Fans of a team can potentially be or are target customers for the sponsor. For example, Muthoot group which is a south India based firm, sponsors CSK whose fans are densely concentrated in the south.

ESP properties, the entertainment and sports division of GroupM, estimates that CSK, KKR and MI are the most followed teams across the country9

Graph 4: Number of followers on television and social media (Facebook, Twitter & Instagram)– 20199

Revenue from sponsorships are correlated strongly to the team’s followers as seen in the graph below.

Graph 5: IPL teams of followers on Facebook by % share of sponsorship revenue10 11

Presence of marquee players and celebrity owners have a say in franchisee popularity. These marquee players give an upper hand to the franchises while negotiating with sponsors. In most cases, the sponsors are willing to pay a premium to be associated with that team.

Merchandise sales

Merchandising is majorly an unexplored area for IPL franchises with less than 1% of the revenue coming from this, compared to foreign leagues which earn 10% – 20%.

On one hand Sports franchisees can market and sell products themselves. Teams across major sports leagues such as New York Yankees (NFL), Green Bay Packers (NFL), Manchester United (EPL), Boston Bruins (NHL) etc. sell a wide range of own branded products from (doormats to car windshields) via their online stores with worldwide shipping and few Experience-centres/ showrooms. Among IPL franchises, Chennai Super Kings has its line of merchandises (men & women’s wear, watched, kids’ toys, collectables, school kit, board games, mobile case etc.) which are sold on their website and online platform – prepsportswear.com. Even teams with newer leagues such as Jaipur Pink Panthers (Pro-Kabaddi League franchisee) are selling merchandise on their official website & app.

On the other hand, some franchises/ individual players choose to enter into a fixed fee/percentage income arrangement with one or more companies licensing them to market branded products. Manchester United had entered into a £750 Mn merchandising deal with Adidas for 10 years in 2014, where Manchester United gets £75m ($128m) a season12. This is a 3-fold jump from its previous deal with Nike for £23.5 m a year12. Liverpool FC has collaborated with CRC Sports to open 3 retail stores in Thailand to sell co-branded products13.

Match day Income

Proceeds from ticket sales during the seven home matches contribute to ~15% – 20% of total revenues. Qwixpert’s analysis indicates mature leagues such as NBA or Premier League generate almost 1/4th of their revenues from ticket sales

Revenue generated is a factor of number of seats in the stadium and individual seat price. While the number of seats in the stadium is fixed, the key is to optimize the number of seats sold, which is constrained by the number of complimentary seats allocated and utilization of the available seats sold per match. Complimentary seats given out to sponsors, associations, players and others come with its pros and cons. The disadvantages are the potential loss of sale from these seats and an expense of 28% GST on the price of each ticket. Our project experience in Indian Sports League indicates an opportunity to rationalize the number of complimentary seats and reduce the loss from GST on complimentary seats.

Under-utilization of stadiums is a constant concern for IPL franchisees. Utilization is seen to be driven by opponents and their popularity/ rivalry. When popular teams play 95%+ utilizations are seen compared to 70%-80% utilization for other matches, bringing down the overall utilization of the stadium in the season.

IPL planning committee, with adequate push from franchisees, try and ensure scheduling of high profile matches during prime time (Friday/ Saturday 8PM) as much as possible. Promotional offers on ticket sales such as “buy one get one” or discounted rate sales are some tactics adopted by franchisees to drive up seat utilizations.

Ticket prizes typically range between ~₹300 and ₹40,000, varying for each stadium. For matches against popular teams, there is a high demand for tickets. Stand and seat level dynamic pricing can be evaluated to enhance utilizations and improve contribution per ticket. Mature leagues have been dynamically pricing tickets for 15+ years. In 2004, MLB (Major League Baseball) teams priced their tickets differently basis the season, day of the week, holidays, opposition quality & stars in the opposition15. Qwixpert’s proprietary algorithm helps franchisees gain ~10 – 15% more revenues from ticket sales by measuring price elasticity by evaluating the aforementioned factors and more.

Tracking ticket sale data live helps decide price dynamics. Shifting 100% of ticket sales to online platform aids in gathering data, which sports franchisees across the globe use to draw insights on customer behavior and aspirations to tailor their ticketing approach.

Prize money

The 4 teams qualifying for the knock-out phase are incentivized with an additional prize money. In 2019, the total prize money was ₹50 crores and were distributed as mentioned in Graph 6. IPL rules mandate that at least 50% of it is distributed to the players. Teams are also entitled to receive an additional prize money basis their league standings, prior to their final finish post the qualifier stage.

Graph 6: IPL 2019 Prize money

Other income

On match day open spaces in the stadium are rented out to food & beverage stalls or for stalls for brands who want to promote their products. An underutilized part of revenue levers, as major global leagues generate as much as ~5% of their revenues from concessionaire incomes14. Player trades mid-season between teams may generate incomes or expenses depending on the trade conducted.

Conclusion

Inspite of its overwhelming popularity and aggressive valuations, IPL remains a maturing league with several revenue growth opportunities for individual teams. Reducing dependence on central rights incomes and increasing saliency of other income levers will grow and sustain franchisee valuations. Match day revenue enhancement opportunities by plugging leakages and efficient utilization of seating exist. Further, franchisees have only skimmed the surface when it comes to merchandising and sponsorship revenues. IPL teams need to also evaluate themes around concessionaire incomes and leveraging social media to continuously engage fans throughout the season. With cricketing passions continuing to rise, India being able to unearth world beating talent at increasing frequencies and IPL style regional leagues mushrooming all around the country, the future is bright for the product. It is therefore imperative for franchisees to act along the major themes discussed here, in earnest to ride this wave, or should we say tsunami.

Stay tuned as we analyze the expenses in a similar vein in the second part of this study to recommend solution themes to improve franchisee profitability.

Author: Giridharan Raghunathan, Gopika Hemachander