Executive Summary

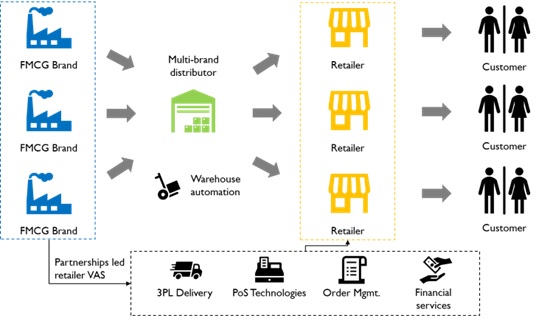

Emerging Tech based B2B models are disrupting the traditional distribution space. Unlike the traditional distribution model which has only one source of revenue i.e., via trade of products, the new age tech-driven businesses can generate income from advertisements, data analytics, private label sales, financial and PoS services. These allow online platforms to pass higher product margins to retailers. FMCG Distributors must offer additional value and create differentiated offerings to retailers to level the playing field. Consolidation in distributor territories will be actively pursued by FMCG brands. Multi-brand master distributors akin to those in consumer electronics and global auto sales are expected to emerge. Partnerships with financial institutions, PoS solutions providers and distributed warehousing for faster replenishment. Additionally private labels and backward integration into 3PL and warehousing services can add to distributors ability to compete.

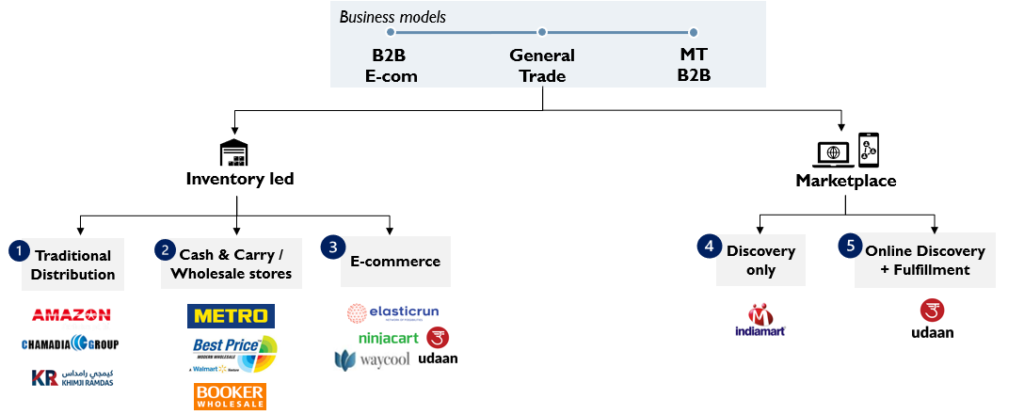

Emerging Business models in B2B Distribution landscape

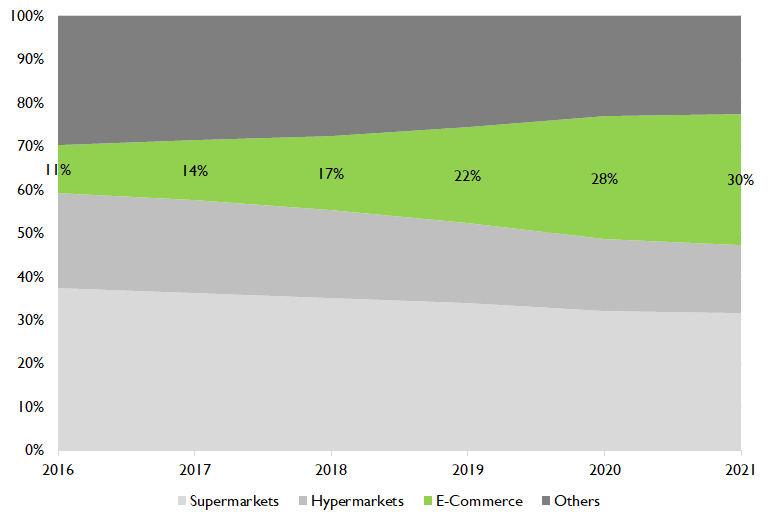

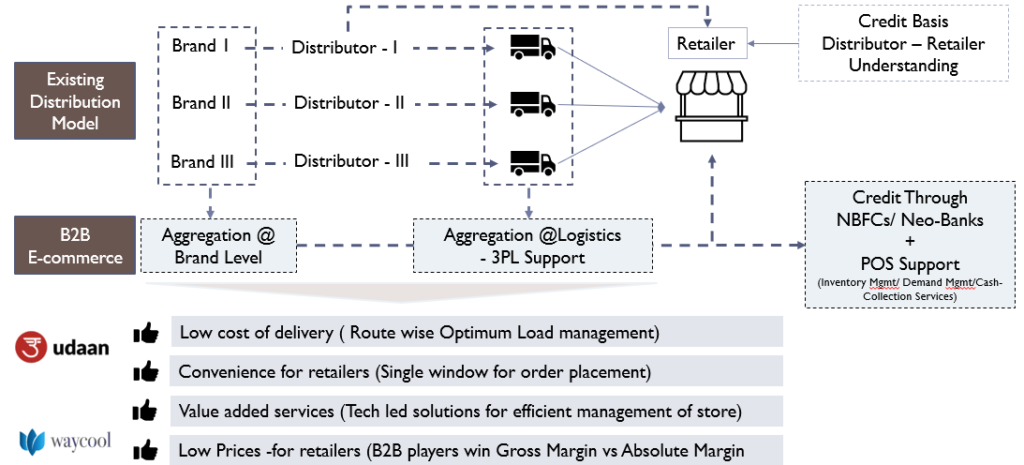

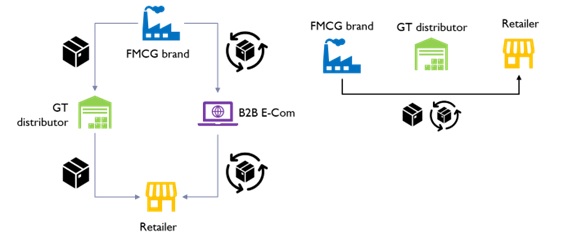

Initially FMCG downstream supply chain had a “distributed” channel structure. Traditional distributors covered towns or part of towns and were mostly exclusive to a particular brand, built relationships with the many thousand general trade outlets and wholesalers operating locally. Retailers in a town depended on these distributors to deliver orders or visited wholesalers to pick up required stock. This traditional distributor managed demand and working capital efficiently doling out micro-credit and also drove trade marketing initiatives for the brands. This model was first disrupted by the brand aggregators – Modern Trade Wholesalers like Metro, Booker and Walmart. These MT outlets offered a one stop-shop for retailers across brands and categories, but did not offer door-step delivery unlike the traditional distributors. The informal credit practice was also not extended. Prohibitive freight costs in low volume towns meant direct coverage was ~50 – 60% for even the biggest of FMCG brands. Online platform led distribution wishes to offer the best of both worlds – aggregated demand to be a one-stop shop for the retailer, amortizing freight costs to ensure direct distribution with door-step delivery and offer micro-credit with partnerships.

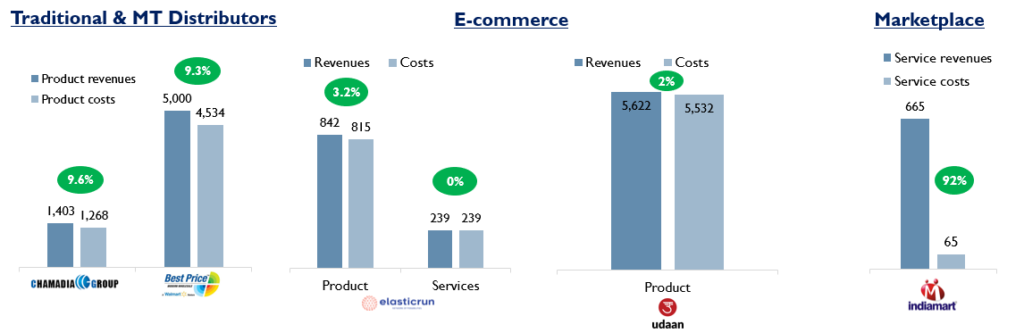

Fig 1: Comparison of different business models in FMCG B2B distribution

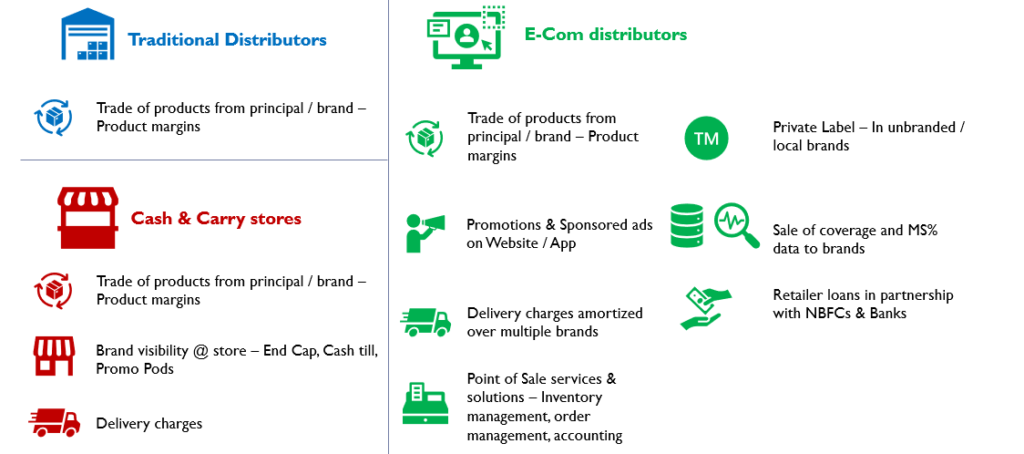

The traditional distributor and the cash & carry wholesaler-built businesses on an inventory led model, where stock is purchased from FMCG brands to be resold. Working capital management becomes critical with low profit margins and large revenues. Success depended on the business owner’s ability to rotate capital as many times as possible. Marketplace platforms, avoiding taking inventory onto their books by creating a platform for buyers & sellers to engage directly. They may or may not undertake order fulfilment creating two business models – Discovery only and Discovery and fulfilment.

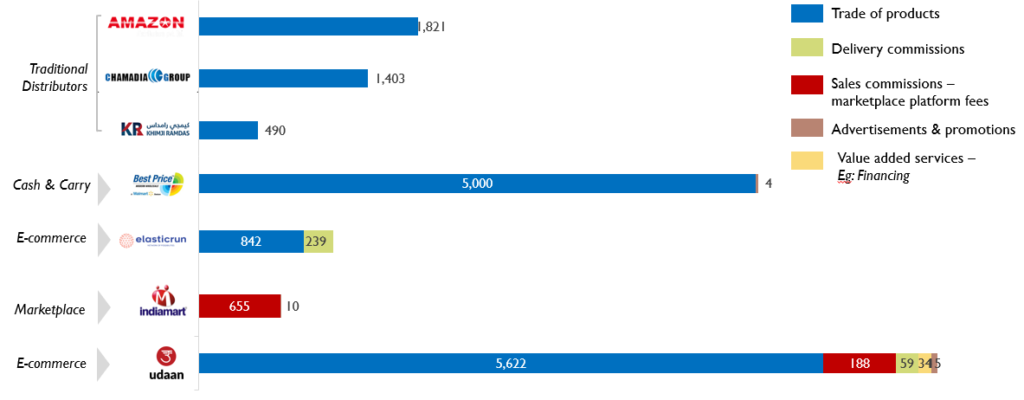

Each of these Business models have different sources of revenue

Analysis of each business highlights the various revenue models in play. A traditional distributor generates revenues on the wholesale trade of products and manages all costs of operations within the margins offered by the principal brand(s). Cash & carry stores can additionally generate promotional income from brand visibility – on shelves, cash tills, end-caps and in-store promoters. In the recent past, cash & carry wholesalers have built websites and mobile applications to allow retailers the convenience to order online and get deliveries for an extra charge.

Fig 2: Comparison of operating revenue streams in FMCG B2B distribution – FY21

E-Commerce platforms using the inventory or the marketplace model generate promotional income from brands through brand pages, search based advertisements and sponsored listings. Organizations like Udaan, Elastic Run are additionally offering micro-credit to fund for the retailers’ working capital.

Profitability built on lean and efficient operations in inventory models

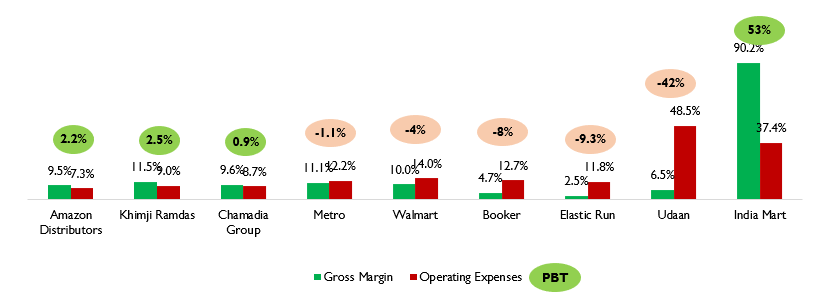

Fig 3: Comparison of operating revenues, costs and margins across business models – FY21

The traditional distribution system operates on a gross margin of ~8 – 12%, for mass market products. These wafer thin margins, drive the distributor ecosystems to have lean and efficient operations. Low inventory levels with “Fast moving” stock characterises the inventory model and hence offers the name to the industry – “Fast Moving Consumer Goods”. Manpower productivity and optimized freight costs are critical to profitability and so is effective credit cycle and cash flow management. Companies operate with 15 – 20 days of stock and ~20 – 30 days of payable and receivable days. This working capital is usually the investment made by the distributor and if these benchmarks are maintained, the distributor can expect an RoCE of ~30%. Qwixpert’s analysis indicates the median RoCE of the top distributors of the country is ~33% and they operate at 21 days of inventory, 20 days of sales outstanding and 15 days of payables outstanding.

The contrasts can be noted in Indiamart’s marketplace model, where the gross margins are at ~90%. The marketplace platform charges fees on the discovery and engagement between buyers and sellers, while IT & employee costs borne to manage engagement & discovery are the primary cost of services.

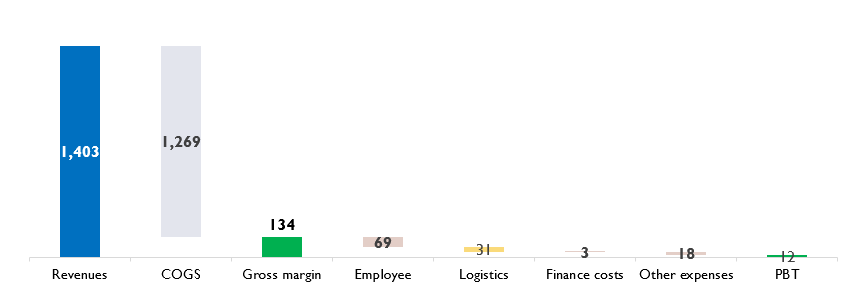

Assessment of cost drivers indicate the need for lean business operations to drive profitability

The traditional distributor is not too worried about revenues. The margin and the “fast moving” nature of the merchandise are more critical factors in deciding the SKUs to stock and volumes to purchase. Higher the premiumness of the merchandise, higher the gross margins. To drive profitability, the distributor from hereon, effectively utilizes assets – warehousing infrastructure, logistics network, inventories, sales & distribution manpower. Four key metrics – SKU throughput, freight cost per unit, manpower productivity and inventory days – are measured and optimized for religiously. An analysis of one of P&G’s largest distributors – Chamadia Group (Fig 4) – indicates how razor thin profit margins look when compared with product revenues. But, a comparison with the gross margins indicates a reasonable 9% profitability before tax.

Fig 4: Chamadia Group – Profitability waterfall – FY21

The modern trade wholesalers are yet to make profits and the likes of Walmart benefit at a group level from the Indian office, by sourcing private label manufacturers for their global businesses. Negative bottom lines are also a reflection of the operating costs not being lean, as seen in Fig 5 – This can be noticed from the similar gross margins to traditional distributors but much higher operating costs. The online distributors – Elastic Run, Udaan – have much thinner gross margins, indicating their aggressive pricing to capture the market. Udaan’s overheads are significantly higher and need to be drastically optimized or monetized for profitability. Elastic Run’s operating costs are in line with traditional businesses, indicating a much tighter business.

Fig 5: Profit margins as a % of revenue – B2B distribution businesses – FY21

There are primarily 2 ways by which firms can increase their profitability in B2B distribution landscape i.e., Optimizing the cost-to-serve or by increasing the product margins.

In the Traditional Distribution business, cost-to-serve is optimized by enhanced productivity of manpower and/or investing in supply chain automation – warehousing to achieve a trade off between throughput, storage density and labour expenses & logistics – inhouse vs 3PL, route & fleet optimizations. Increasing the mix and throughput of premium merchandise (higher margin products) in sales can increase profitability. Upgrading the customers to higher margin products is a function of consumer economic growth and brand marketing. The E-commerce distribution model, on the contrary, offers new income streams compensating for the higher margin passed on to the retailer.

E-Commerce businesses bet on new revenue streams to overcome higher costs

Traditional distributors begin to extend their businesses into the premium range, with non-competing brands or in non-competing geographies to increase bottom-lines. Chamadia Group, for instance, has a separate business focused on distribution of imported & premium products. Higher margins are also present in selling unbranded and locally manufactured products – Eg: Grains, pulses, local snacks and by venturing into Private labels. Existing retail coverage and the understanding of the General Trade market are key USPs which traditional distributors can leverage to succeed in private label businesses.

The Cash & carry players offer Product placement / positioning within their stores i.e., Endcap and Cashtill display to give brands a competitive advantage. It is often available for lease to the brands at a cost. Organizations like Walmart bet big on Private labels a ~25 – 30% of their global business is generated from Private Labels.

Additional revenue can also be generated by offering various Value-added services in both online and offline distribution models. Within the online model revenue can be generated from the Brand promotions on the websites / apps, engaging in targeted advertisements directed at an audience with a particular trade pattern or purchasing behaviour. Search Engine Optimization (SEO) services to Brands i.e., charging the brands for listing their products in the top of the search results, are opportunities similar to E-Commerce B2C models.

Value Added services such as extending a line of credit to retailers through tie-ups with Banks to ensure working capital availability to shop owners and sale of Market data to FMCG companies to help them better understand the retail landscape, their market share, penetration, and demand preferences, are potential revenue opportunities in the e-commerce businesses.

Fig 6: Revenue streams for various distribution models

The traditional distribution finds itself at a disadvantage trying to compete against an more equipped business model. However, the merits of an on-ground relationship between the brand and the retailer through a distributor cannot be overstated. More so in India, where the informal sector’s success cannot be explained only through numbers. Brands are also cognizant of their long partnerships with these distributors and evaluating options to move forward. It is Qwixpert’s belief that the traditional distribution model is still relevant but will undergo changes to remain competitive in the long run.

By 2030, the traditional distributors will consolidate, differentiate with localized products and also offer value added services through partnerships

With the digital disruption in the B2B distribution space, retailers have new wholesalers & distributors to purchase from. This also opens retailers’ option to new product offerings under existing as well as new categories and additional products – Eg: financial services on one platform. Point of Sale services such as invoicing, accounting and replenishment can be integrated which makes order placement, fulfilment and GST filing simple and fast for retailers.

Traditional distributors are expected to consolidate to become multi-brand and multi-category distributors. Global multi-brand distribution operating models as seen in Electronics (Eg: Ingram, Redington), Automotive (Eg: Autonation, Penske) are soon to be replicated to compete successfully against online platforms. Traditional distributors with close proximity to their retailer network and local connections, will cater to local tastes with regional brands. Online players with centralized procurement function will be slow or unable to adequately capture localized customer preferences, thereby limiting their distribution dominance to National Brands and Larger Pack Sizes, similar to modern trade.

Traditional distributors should think beyond working capital management for their principal brands and offer a bouquet of customer services – convenience in order management, shorter fulfilment cycles, category aggregation for basket shopping experience, financial services, inventory management and accounting support. Partnerships with fintech, logistics tech and aggregator platforms can deliver these services at optimized cost.

Traditional distributors are also likely to backward integrate and reduce costs to pass on incremental margins to customers (Retailers). 3PL and warehousing operations for principal brands are one opportunity. Private label product introduction through contract manufacturing, leveraging the vast MSME ecosystem is another opportunity to explore. Further, this would enable Unorganised or Local brands to gain more visibility as their inability to set up penetrated distribution networks impacted retailer reach.

FMCG companies, today depend on Nielsen’s retailer surveys to determine retail market shares and consumer purchase patterns. With technological intervention in order placement and fulfilment, real time and more accurate data would be available with Online marketplaces for brand analytics. These analytical insights will allow FMCG companies to roll out customized trade promotions, reorganize sales force, their beat plans and shorten product launch cycles.

The net result in a decade’s time would be a more consolidated universe in FMCG distribution, with customers – retailers & consumers benefiting the most with a wider choice for purchase, consumption and business support.

Sources:

Introduction

We would remember the times when grocery lists were an ubiquitous phenomenon. The local grocer or the kirana was the recipient of these lists at the beginning of every month from households in the catchment area he served. The need to deliver these lists in person or over the phone to the grocer for pick-up or delivery later in the day is slowly starting to become a thing of the past. Grocery marketplaces, some with instantaneous delivery options (quick commerce), have offered an abundance of convenience to the Indian customer. The easiest way to shop has become via the smartphone and essentials reach home in as little a time as 10 minutes. Convenience and technology led order placement is not limited to the end user and is also an option for the grocer. B2B digital marketplaces have disrupted the traditional FMCG distribution channels. The pace of this disruption and the subsequent channel conflict it has triggered has asked more questions than FMCG companies have answers to. This article analyses the genesis of these conflicts and predicts the direction the FMCG distribution model is likely to take going forward.

E-Commerce is outpacing traditional channels in the $110Bn FMCG market

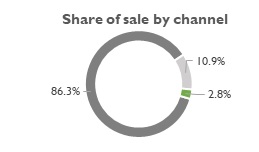

The Indian FMCG market was valued at US $110 Bn in 2020 and is expected to double by 2025 to $220 Bn1. This growth is being driven by growth in rural markets, which are forecasted to beat the urban markets in consumption by 2025. FMCG retail landscape in India is dominated by traditional trade with its mom-and pop stores sells which accounts for ~86% the market (Fig 1). Digital channels including E-Commerce and D2C (Direct to Consumer) are growing much faster than the traditional channels, with Accenture estimating that top FMCG companies derive ~7 – 8%2 of sales from these channels. Marico’s E-Commerce business contributed ~1% in FY173 and has grown to 8% by FY214. Dabur’s E-Commerce business has tripled in saliency from ~2% in Q2FY21 to ~6% in Q2FY225. ITC has seen similar progress with the digital channels contributing to 7% in Q2FY226 as against 5% in FY21 and ~2.5% in FY207. This increase is spurred by the disruption by marketplace platforms such as Big Basket, Udaan, Dunzo, Amazon Pantry, Flipkart, Jio Mart.

General Trade Modern Trade E- Commerce

Fig 1: FMCG sales split by Channel – 2020

Fig 2: E-Com contribution in leading FMCG firms

With the ease of access to digital infrastructure, there has been a rise in the number of internet users. According to the Ministry of Electronics and Information Technology (MeitY), there were 448 Mn active social media users in India in February 2021. This in turn has influenced online shopping trends with social media being the biggest customer acquisition channel. On the other end of the shopping spectrum, lies the General or Traditional Trade.

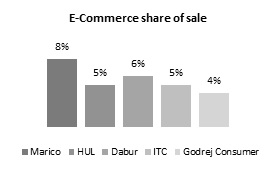

The general trade with ~13 million outlets and Modern trade with ~18,000 outlets (as per Nielsen estimates) sold FMCG products to customer. With the advent of technology, a customer today can approach alternate channels such as social media, marketplace platforms or company websites and apps for their favorite brands. Social commerce, reseller models and O2O (Online to Offline) have emerged as popular alternative channels in China and have enabled disruption across all retail categories – Food to Furniture to Fashion. The FMCG distribution model in India now has at least 7 unique channels, substantial in market size as shown in Fig 3.

Figure 3: FMCG Distribution Channels

Coverage gaps and enhanced technology penetration enabling B2B E-Commerce advent

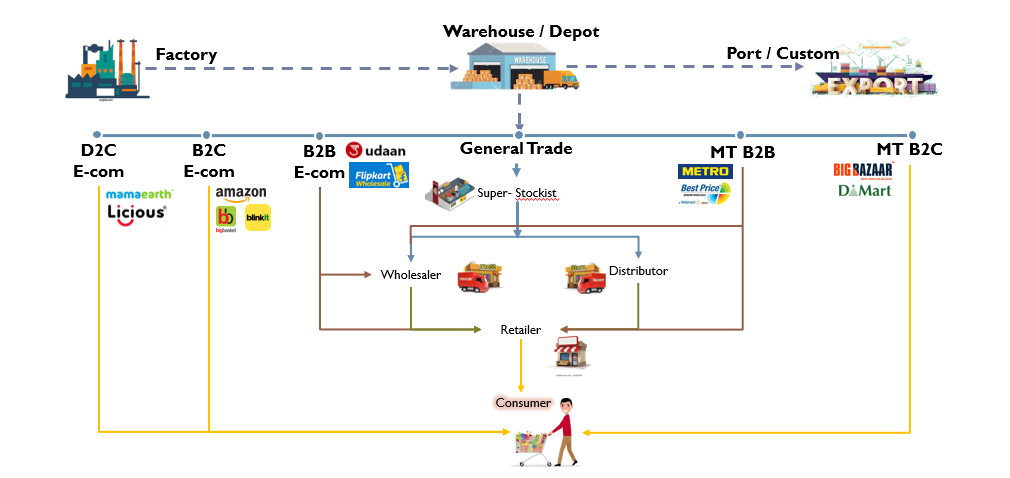

With the advent of new channels – D2C, E-Commerce – the FMCG customer or channel partner is set to gravitate towards to online channels steadily over time. This migration is expected to be sharper in urban markets, accentuated by the COVID-19 pandemic. The Chinese Urban FMCG market has seen a near 20%+ increased contribution from E-Commerce in a mere 5 year period (Fig 4), with a growth rate of nearly 35% YoY. The Indian economy is expected to follow a similar trend, even if not at such a frenetic pace.

Fig 4. Share of retail sale by channel – China FMCG Urban market

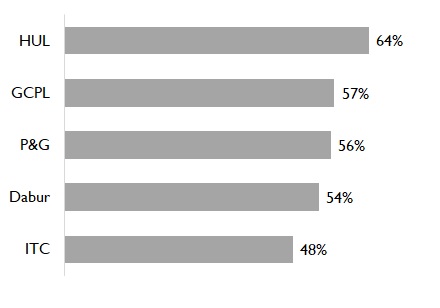

Traditional distribution channels in India contribute to 86% of the FMCG business but direct penetration of even FMCG leaders are ~60% (Fig 5). FMCG companies have coaxed, incentivized and disincentivized traditional distributions to ensure direct coverage, only for the distributors & wholesalers to successfully argue against it with the financial unviability of a direct distribution model. While a vast majority of the remaining 40%, primarily in rural geographies, get covered through indirect distribution (wholesalers, retailer -> retailer purchase), challenges remain in logistics, lower margins for channel partners and higher than MRP prices for customers.

Fig. 5. Direct Customer Penetration

These challenges have paved the way for B2B E-Commerce firms to enter, disrupt, plug coverage gaps and offer value added services to both FMCG companies & retailers. Companies like Elastic Run, Udaan, Jio Mart are being operated on this premise and are unicorns today.

Rise of channel conflict between traditional distributors and B2B e-commerce

With the emergence of B2B E-Commerce, urban markets have emerged early adopters, transferring a share of the pie from traditional distributors to these online platforms. Competition has given way to channel conflict and the FMCG firms are caught in the crosshairs. The new year of 2022 brought new challenge for major brands. In the month of January, distributors in Maharastra9, went on a strike and stopped selling HUL products, followed by distributors of colgate palmolive. Dhairyashil Patil, President of The All India Consumer Product Distributors Federation10 and The Maharashtra State Consumer Product Distributors Federation (MCPDF), told Business Line that the decision was taken due to brands refusal to engage with them on their concerns regarding the lack of price parity between traditional distributors and organised B2B distributors (Jio Mart, Metro, Walmart and Udaan).

All India consumer products distributor federation11 alleged that FMCG companies were selling products at lower prices to B2B distributors and further the organized B2B distributors were selling the same products to retailers at a lower price. In response to the AICPDFs concerns, Amul and Parle have stopped direct supply to Udaan12. Other large FMCG organizations such as HUL, Marico have acknowledged the issue publicly and have promised credible steps13 to support fair returns on investment for their general trade distribution channel.

We at Qwixpert have spent time analyzing the issue in depth and also offer solutions to FMCG organizations to address channel conflict.

The E-commerce distribution model offers an attractive value proposition

Let us start by understanding the operating model and value proposition of emerging B2B distributors such as Jio Mart, Udaan, Elastic Run and others, to both the FMCG players (suppliers) and Retailers (customers). Convenience through technology enablement, value added services and network effects of supply & demand consolidation are core principles of operation (Fig 6).

Fig 6: Value proposition – B2B E-Commerce

B2B E-commerce business’ income streams threatens multiple business models

The value proposition, as noted above, substantially elevates the nature of competition to traditional distribution channels. This coupled with the potential to derive income from several new income streams can alter the very foundation of FMCG distribution in India.

Control over the demand data allows B2B E-commerce players to offer Private Label products, especially in categories with lower brand loyalty. This will adversely affect revenues of FMCG brands. Partnership fees with various service providers who digitize general trade operations – accounting, financial services, inventory & demand management. Some companies have even launched their own fintech arms. The digital platform and marketplace business model offers monetization opportunities – digital marketing – search & display ads, brand promotions, charges on fulfilment services, listing & discovery fees, sale of demand data post analytics to brands.

These income streams disrupt multiple industries and functions – Asset light approach to retail sale data will impact retail research agencies like Nielsen and Kantar, Private Label sales opportunities will promote massive contract manufacturing opportunities for MSMEs and demand aggregation may make sales organizations leaner in traditional FMCG firms. The general trade distribution model also offered higher visibility over retailer sales data with sales people collecting & servicing orders. Loss of control over this data gold mine and the evidenced success of private label in global markets, have made FMCG firms circumspect.

FMCG brands can invest in assets, new partnerships & technology to address conflict

Despite general trade being the major source of distribution in India for decades, ~50 – 60% direct retail coverage creates a just cause for E-commerce businesses. The growing Indian market allows for both traditional and e-commerce channels to co-exist profitably although the status quo will have to change. FMCG brands can take several steps to resolve channel conflict and achieve inclusive growth across channels.

Channel conflict is not new to FMCG business – was seen when modern trade emerged. Most notably, consumer electronics has seen an aggressive version of this conflict with the emergence of E-Com marketplace platforms.

Fig 7: Channel exclusivity and Direct to Retailer distribution

Fig 8: Multi-brand General Trade distribution system with Competitive services

Conclusion

Technology adoption in the country is rising at a frenetic pace. With the emergence of B2B marketplaces, traditional processes have been disrupted and the ensuing channel conflict is now unavoidable. The future state of equilibrium will iron out inefficiencies but must ensure an equal competitive platform for traditional and online marketplace channels. A win-win scenario does exist but it is not a quick fix. The higher degree of convenience and lower cost of service will gravitate retailers towards to B2B E-Commerce companies unless the FMCG brands and distributors equip themselves adequately.

The traditional channel of distribution must undergo massive changes in its operating model to remain competitive. FMCG companies must invest in distributor operating model upgrades. Partnerships with fintech, logistics and point of sale technologies will equip general trade distributors to compete with online channels and also reduce their costs and working capital pressures. Consolidation of general trade distribution similar to global models in automotive and electronics industries is expected.

– Giridharan Raghunathan and Ayushi Barnwal

Sources:

1. https://www.ibef.org/download/FMCG-September-2021.pdf

2. https://www.livemint.com/industry/retail/ecommerce-emerging-as-bigger-retail-channel-11623690512609.html

3. https://marico.com/investorspdf/Marico_-_Harnessing_Digital_-_Arisaig_Partners_Consumer_Symposium_2017_-_September_17.pdf

4. https://www.livemint.com/companies/news/heres-how-much-e-commerce-is-contributing-to-sales-of-large-fmcg-companies-11626611943905.html

5. https://www.businesstoday.in/latest/corporate/story/dabur-india-q2-profit-rises-20-to-rs-482-crore-e-commerce-biz-grows-over-200-277548-2020-11-03

6. https://www.business-standard.com/article/companies/itc-doesn-t-rule-out-listing-infotech-biz-open-to-creating-value-for-fmcg-121121401480_1.html

7. https://www.livemint.com/industry/retail/itcs-fmcg-sales-via-e-commerce-doubled-in-fy21-11626348915830.html

8. https://www.bain.com/insights/a-sudden-slowdown-in-2021-fmcg-recovery/

9. https://www.thehindubusinessline.com/companies/now-distributors-to-block-hul-colgate-products-in-4-more-states/article38094485.ece

10. https://www.thehindubusinessline.com/companies/after-hul-maharashtra-distributors-to-stop-selling-products-of-other-fmcgs/article38081998.ece

11. https://www.livemint.com/industry/retail/fmcg-distributors-seek-level-playing-field-threaten-firms-of-noncooperation-11638771763050.html

12. https://economictimes.indiatimes.com/tech/startups/amul-parle-others-stop-direct-supply-to-b2b-startup-udaan/articleshow/85964942.cms

13. https://www.thehindubusinessline.com/companies/after-hul-maharashtra-distributors-to-stop-selling-products-of-other-fmcgs/article38081998.ece

Digital in numbers, but not the numbers corporate India is used to seeing

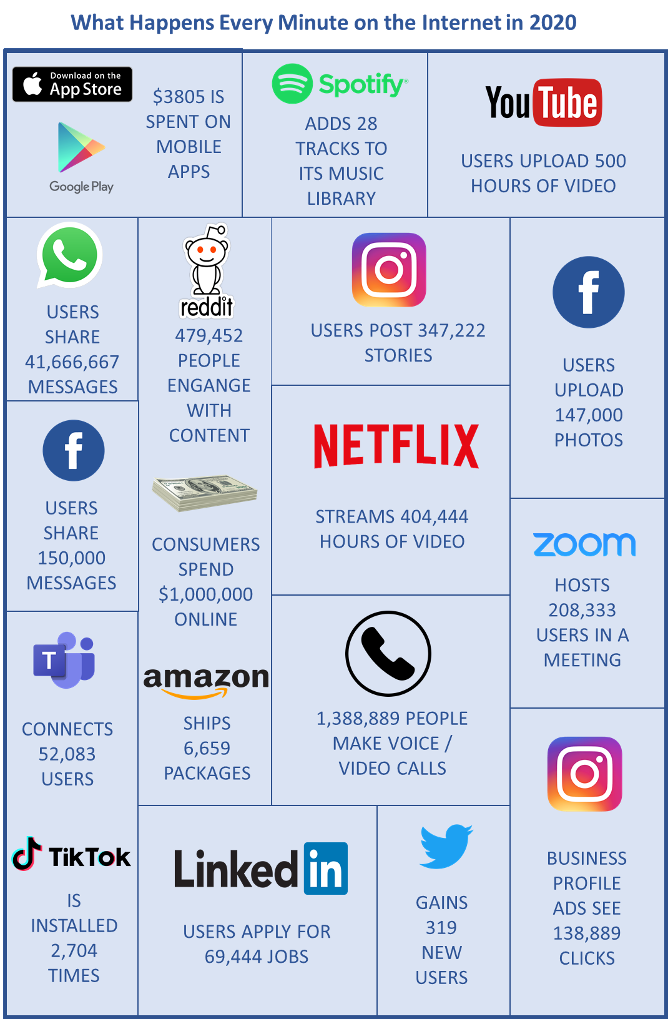

In this day and age, yesteryear business metrics such as revenue growth or profit margins, cannot adequately summarize the nascent yet vibrant digital industry. The reason why we call it nascent is that despite several decades of existence and investment, there is this overwhelming feeling of not having unearthed more than the tip of the iceberg. If you are still not convinced, just glance at the chart below.

No other industry today spawns so many innovative business models, many of which were launched from the comfort of a couch. The disruption to traditional industries due to these businesses is vast and almost immediate. Like most of you, we at Qwixpert have been repeatedly astonished by the progress made in thought and action by these businesses. “Digital” also dominates discussions in the corporate world, so much so that if a word cloud of all corporate utterances were to be created, “Digital” would probably take center place in the largest font size.

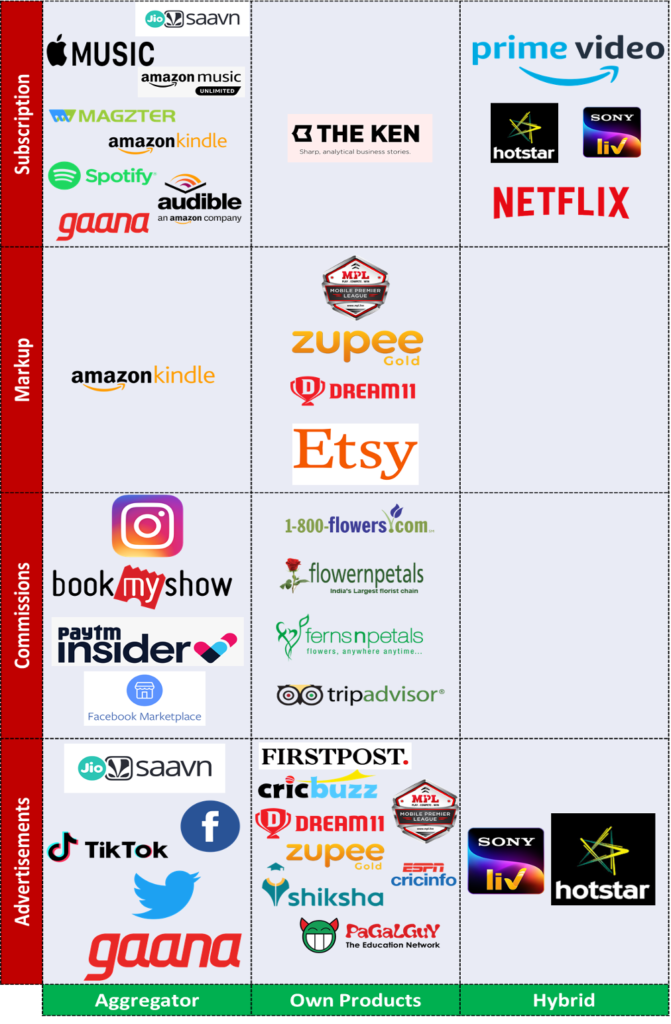

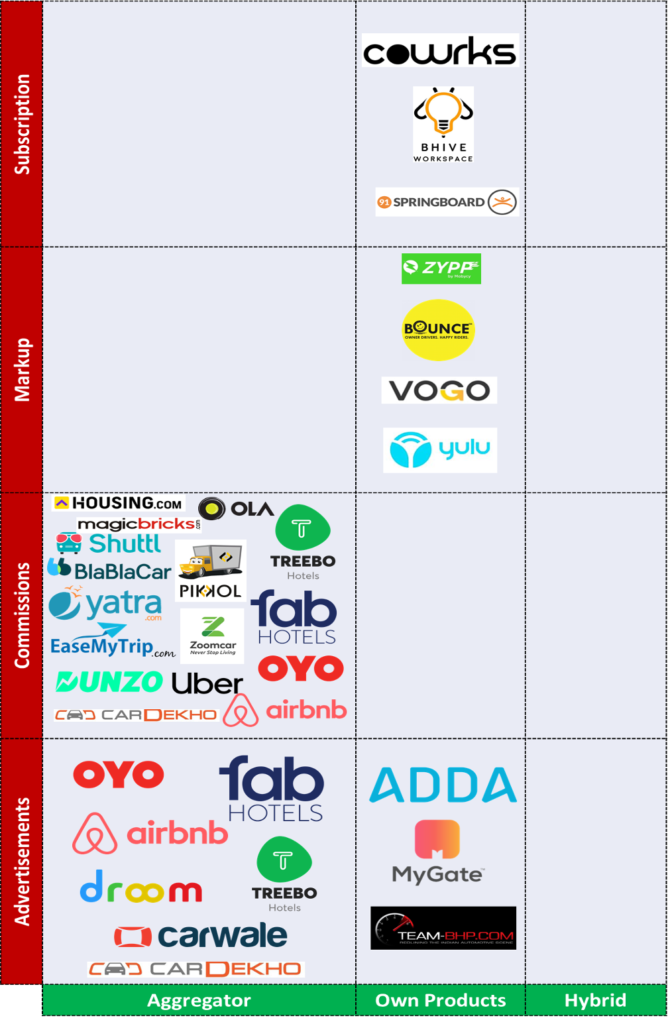

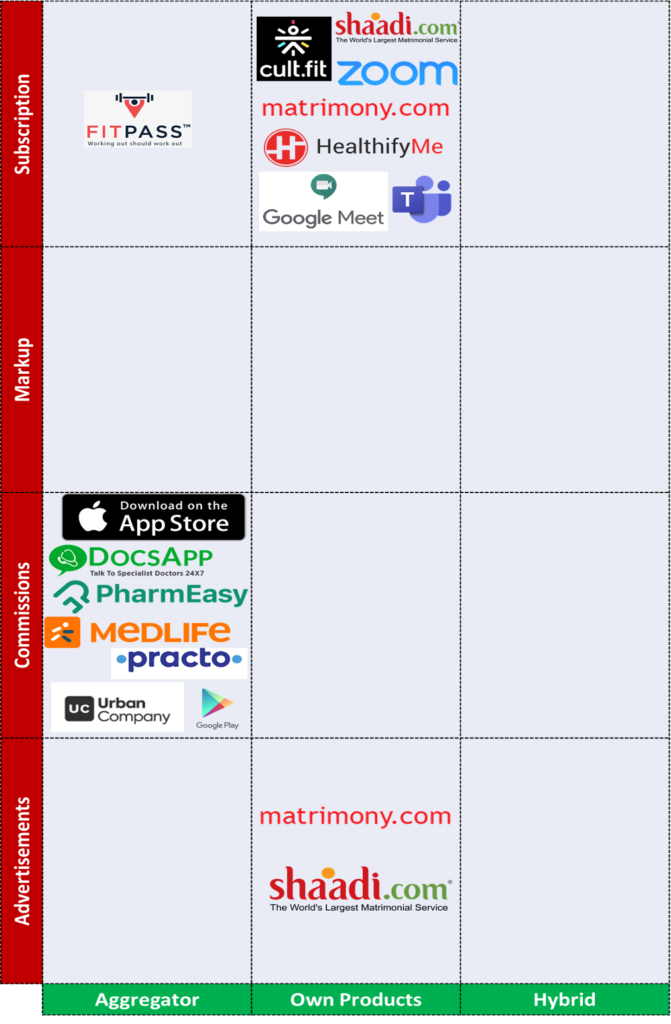

As “Digital” increasingly permeates our world, we have attempted to organize and structure it into a “Landscape.” We have limited our research to only Digital B2C businesses. The “Digital Landscape” is essentially a 2×2 matrix with “Business Model” and “Revenue Model” as its axes. These axes are defined as below

Business models can be classified into three kinds basis how consumers interact with the offerings on the digital platform

While the fine print on business contracts will reveal subtle differences in their revenue generation models, four principal types stand-out

We have tried to “landscape” several industries into a 2X2 chart – Business Model X Revenue Model. While it is not an exhaustive list, a wide variety of companies operating in the following five industry sets are covered

While companies do have hybrid revenue models, a separate category has not been carved out, but both are highlighted in case multiple revenue models are present. E.g., LinkedIn generates revenues through advertisements as well as subscriptions.

Retail – General Retail, Food & Grocery, Durables, Fashion, and Home décor

Entertainment & Leisure – Social media, OTT, News, Gaming, Music, and Gifts

Productivity – Education, Recruitment, Financial Services, and Open Source

Hospitality & Transportation – Automotive, Travel and Real Estate

Services – Health & wellness, Household help, Matrimony, and Virtual meetings

Sources:

Executive Summary

The coronavirus pandemic and the subsequent lockdown has crippled the foodservice industry. With operational constraints and an increase in customer apprehensions about ‘outside food’, the industry has to innovate to survive the crisis. In the recovery phase, the focus must be on sustaining business operations, operational solvency, and curating customer experiences.

In this article, Qwixpert explores some of the digital and on-ground interventions adopted by restaurants. They are offering safe dining experiences through contactless dining, social distancing at premises, and unmanned delivery kiosks. Innovations such as automation in food preparation, dark kitchens, and using online delivery channels can reduce cost burdens. Engaging with customers through social media can abate fears and influence them to eat out again. The industry is set to transform, and the changes will outlast the pandemic.

Background

The Foodservice industry is amongst the worst-hit sectors due to the Novel Coronavirus. Apart from being completely shut during the lockdown period, diner’s apprehension about consuming non-home cooked food and the fear of virus transmission in public spaces have continued to keep customer footfalls low even during the unlock phases. This drop in demand, coupled with a shortage of staff and disruptions in the supply chain, has led to an estimated $9 billion loss. Thus, bringing into question the industry’s sustenance in a post-COVID-19 world. As the foodservice industry opens up and slowly moves forward, we have analysed how their operating models have evolved to keep pace with the demands of the time.

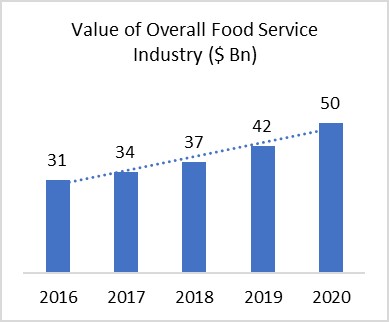

A $50 Billion industry with positively aligned macroeconomic indicators until the COVID-19 outbreak

The Indian market is valued at $50 Billion. The organised sector contributing to 30-35%, comprises of Casual Dining, Quick Service Restaurants, Bars and Pubs, and the Unorganised sector (65-70%) are made up of Dhabas, Roadside eateries, Sweet shops, and other smaller establishments.

The Foodservice industry has grown at ~13% CAGR (2016-2020). The growth was driven by increased frequency of eating out (6.6 times a month) and more spend on restaurants monthly (Average: Rs 2500 a month)

Online delivery, one of the most significant disruptions in the Food Service industry over the past decade, accounts for $1.54 Billion with a 3% share in the overall foodservice industry. It has been growing at 17.5% CAGR due to an increase in discretionary spending power, internet penetration, and a rise in the millennial population.

This period of strong growth has been interrupted by the pandemic. In the “Unlock” phases post the lockdown, restaurants were estimated to be operating at ~50% of their pre-COVID levels resulting in negative operating margins. The industry is expected to go through a long and slow recovery phase. New norms and practices have been implemented to meet Government stipulations and assuage customer concerns. We expand on the most visible and the not so visible ones below.

1. Providing a safe dining experience is the topmost priority

State SOP’s mandate thermal screening of all diners at the entrance, use of facemasks by employees and, in several instances, has capped seating capacity to 50% of pre-coronavirus levels. In several outlets, disposable cutlery and paper napkins are used, the tables and chairs are sanitised before and after use, and waiters use gloves and face shields while interacting with the customers. In June, the SOPs for restaurants in Chennai included food-bearers being mandated to wash hands every 30 minutes once.

Restaurants are redesigning their premise to make provisions for social distancing. Restaurants have spaced out the furniture and installed plastic curtains to create make-shift booths. As research has proved that the virus can transmit quickly in crowded indoor spaces, few restaurants are creatively using parking spaces to develop outdoor seating, offer drive-through take away or provide contactless drive-in restaurant service. In a recent survey conducted at Chennai, 61% of the respondents preferred to wait for a cure before venturing out for dinner; 73% preferred a drive-in option.

II. Adopting digital interventions to reduce contact with customers and dishes

Across the food preparation process, multiple people (chef, waiter, and other staff) touch the food increasing the chances of virus transmission. Automation in food preparation and delivery can reduce contact and abate fear – Robochef, a restaurant in Chennai, uses an automated kitchen where 600+ pre-programmed dishes can be prepared hygienically with 60% less workforce. Restaurants also use vending machines to offer contactless dine-in and takeaway experience. For instance, Daalchini has smart kiosks in Delhi that provide home-cooked food. The customer can discover the nearby Daalchini kiosks using an app, browse through the menu, and place orders digitally. They can visit the unmanned kiosk within half an hour to pick up their food.

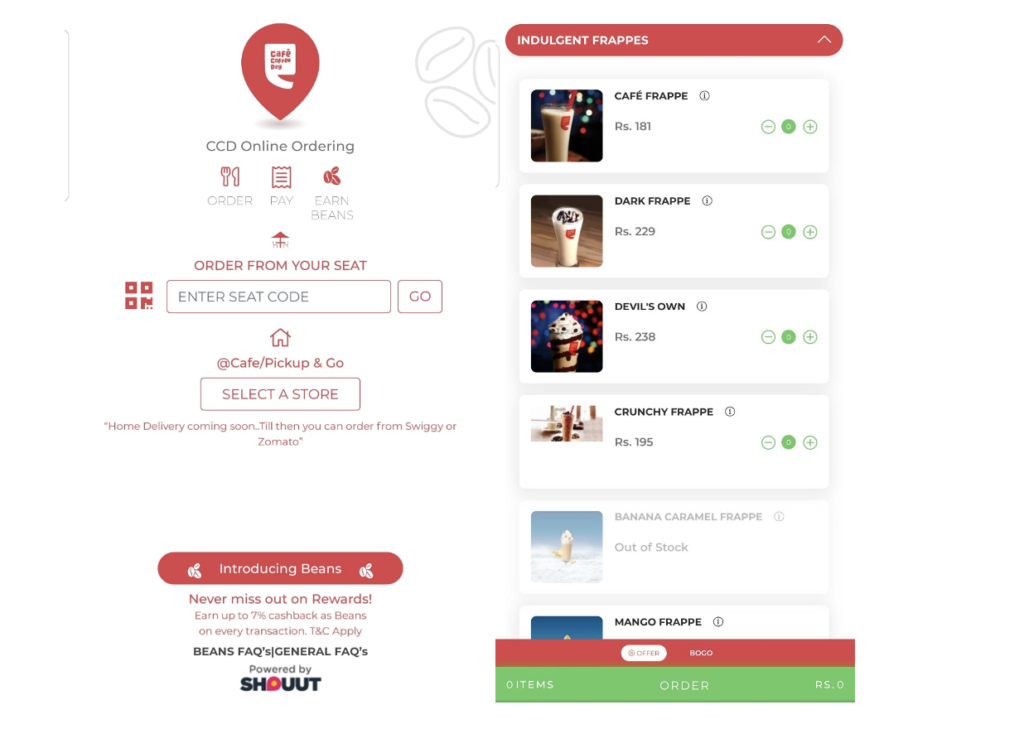

Restaurants have introduced QR code-based menus. Guests now scan the code to access the menu. Online ordering and payment practices are increasing at these times. Café coffee day has managed to open 60% of its stores post-lockdown by offering contactless dining through a web-based platform. Guests order from their seats by entering the seat code (pasted on the table), pay online, and get their food served at the table. The coffee chain wants to harness the data from this portal to understand the need of the customer and optimise a personalised experience for them.

III. Catering to online orders and developing lean operations is the new normal

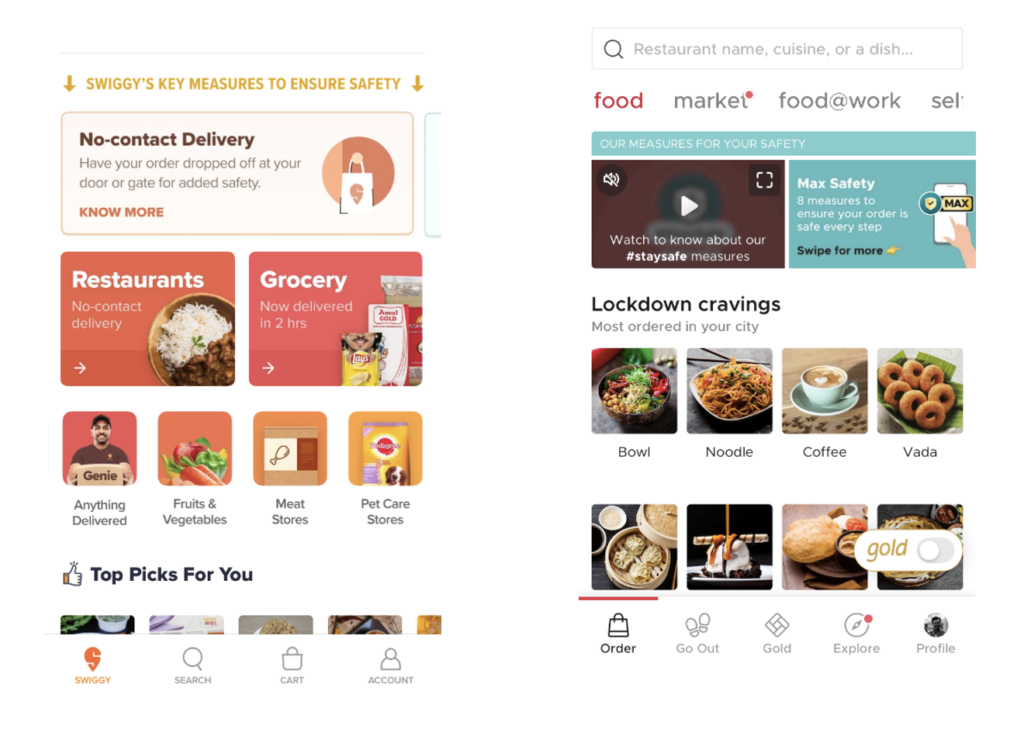

Restaurants may no longer be able to sustain without delivery capability. More and more customers are seeking to order online, and the reliance on delivery channels in the post-COVID world is bound to increase. Restaurants can separate menus – Delivery & Dine-in with a focus on improved packaging quality and have a separate order pick-up zone. Food delivery companies, as well as restaurants, will focus more on creating occasions for customers to order-in—Eg: Swiggy’s ads on delivering even a single piece of dessert to complete a meal. Pubs in the UK have started organizing online pub quizzes and allowing customers to order food and drinks to recreate the dine-in mood.

Restaurants are evolving their business model and setting up Dark kitchens that offer delivery only services and cater to the fast-growing consumer demand through food apps. Faasos, a pioneer in Indian cloud kitchens, was able to grow at 120% and expand to ~1,000 outlets in two years. Zomato and Swiggy have funded and developed ~1,600 cloud kitchens across India, which work on a revenue-sharing basis. These kitchens have been set up in partnership with traditional restaurants like Haldirams, Keventers, and Saravana Bhawan or launched under private brands like The Bowl Company.

While it is reported that Swiggy recently scaled down their dark kitchen business due to massive demand shock, we expect the cloud kitchen model to see more and more takers in the future. They are a safer alternative as customer contact is reduced, and social distancing can be practiced. During the lockdown, most restaurants have operated as Dark Kitchens and have continued even during the recovery phase that is a more efficient model. These kitchens reduce rental costs from ~12-20% to 6-9% of revenues.

IV. Investing in messaging around safety to dispel customer apprehensions and driving customer loyalty through social media campaigns

Marketing during pre-COVID times focused on attracting customers with offers, food choices, and the dining out experience, it has now pivoted more towards safe practice awareness as customer apprehension is at an all-time high. Questions abound on whether restaurants will continue to be looked at as social places for human interaction or functional ones to grab a quick meal in the event of necessity.

Personalised recommendations, loyalty programs, and discounts on food delivery apps along with tags such as ‘Max Safety’, ‘Best Safety’, and ‘Contactless Delivery’ are used to reassure customers who are looking to order-in.

Discounts and offers are still as high (if not more than pre-COVID). Restaurants that deregistered last year following a disagreement with these app-based delivery platforms are returning.

Restaurants are innovatively using social media to engage customers by offering online cooking classes with chefs, live streaming baking sessions, and organising wine delivery & tasting sessions over zoom calls.

V. Focusing on sanitation in procurement

Vegetable markets are being and will be eyed suspiciously by restaurants going forward. A preference for organised players who can be trusted to take social distancing measures, frequent sanitation of delivery trucks, contactless delivery, and online payments will rise. E-Procurement, using blockchain technology, is increasing transparency in the supply chain and makes it easier to enforce hygienic practices. The cleanliness of the ingredients is also a point of concern. Most state SOP’s for restaurants mandates the use of 50 PPM Chlorine to clean vegetables, dal, and rice. Zomato Hyperpure, Big Basket HoReCa, WayCool, and Dunzo are aggressively growing in this segment and cater to over ~10,000 partner restaurants.

Summary

In this race to recovery, organizations are leaving no stone unturned to rejuvenate operations, innovatively serve customers, and minimize the cost of operations. Sanitation of dining spaces, automation in food procurement, preparation and delivery, cloud kitchens, social media led long term customer engagement, and creating at-home dining occasions are where we are headed. As restaurants “reconnect” with their customers, from a safe distance, technology and efficiency are the pillars upon which recovery is being fashioned.

References

https://www.restaurant.org/Articles/News/Study-details-impact-of-coronavirus-on-restaurants

https://www.zomato.com/blog/hyperpure

http://www.careratings.com/upload/NewsFiles/Studies/Restaurants%20%20QSRs%20May%202019.pdf

https://medium.com/collectivfood/the-b2b-food-supply-chain-is-ready-for-disruption-4fd3ace8495

http://ficci.in/spdocument/23056/foodzania-release2018.pdf

http://ficci.in/spdocument/23056/foodzania-release2018.pdf

https://thelogicalindian.com/news/indian-household-bengaluru/

https://d2w1ef2ao9g8r9.cloudfront.net/resource-downloads/2019-Restaurant-Success-Report.pdf

https://www.deccanchronicle.com/business/companies/140119/qsrs-tweak-strategy-to-fend-off-swiggy-zomato.htmlhttps://redseer.com/newsletters/food-tech-market-updates-june18/

Dear Supply Chain Head,

Given the current Covid-19 situation, I am sure you are facing a lot of uncertainties across the supply chain: workforce shortages, transport issues, government plans, demand and supply fluctuations. While there are discussions and speculations about the future, companies must undoubtedly focus on reducing cost, improve efficiencies, and manage their working capital well in the next 12 – 18 months, to emerge stronger out of this crisis.

The purpose of this series is to provide simple but effective ideas to help managers improve elements of their supply chain. In this post, I share a few ideas for enhancing warehouse performance.

It is becoming a challenge for e-commerce and consumer goods companies to fulfil orders due to the non-availability of resources in their warehouses, first and last-mile distribution. The labour shortage situation will take considerable time to improve as a lot depends on when the migrant workers can return from their native. Also, the requirement of social distancing, if implemented well, will slow down processes and productivity levels. The onus is on the supply chain managers to not just resume warehouse operations well – with all the safety protocols but also to improve productivity levels to meet mid to long term goals of the businesses. Here are a few ideas to consider:

Depending on your industry and warehouse operations there could be more ideas ,but 20 – 25 % improvement in productivity is achievable. The key is to identify opportunities, spend time on planning now, and start implementing soon after operations resume.

I look forward to hearing your views on the above ideas and some more ideas if you would like to add.

In the next post, I will discuss the challenges and potential improvement opportunities in the logistics and transportation side of the supply chain.

– Rajan Ekambaram, Partner, Supply Chain Practice Qwixpert